Bullish Engulfing Candlestick Pattern

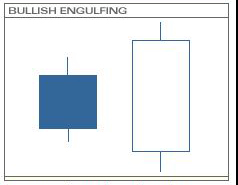

A bullish engulfing pattern is made up of two candlesticks, one after another, and forms during a decline, down-trend, or where there is potential resistance.

The first candlestick has a black body (close lower than open). Shadows are fairly short, if any. The second candlestick has a white body (close higher than open) that is larger than the black body of the first candlestick and completely covers, or engulfs, the black body. The necessary conditions for this to happen are: 1) the open of the second candlestick must be lower than the close of the first, and 2) the close of the second must be higher than the previous open.

The first black candlestick signals a bearish period due to the security closing lower than the open. For the second candlestick, the bearishness continued at the open as it had a lower open than the previous close. However, buying pressure surfaced later on and propelled the security to close above the previous open, hence the bullish engulfing pattern. In fact, if analyzed further, if one would combine the two candlesticks by taking the open of the first and the close of the second, a hammer is formed, which also represents a bearish formation.

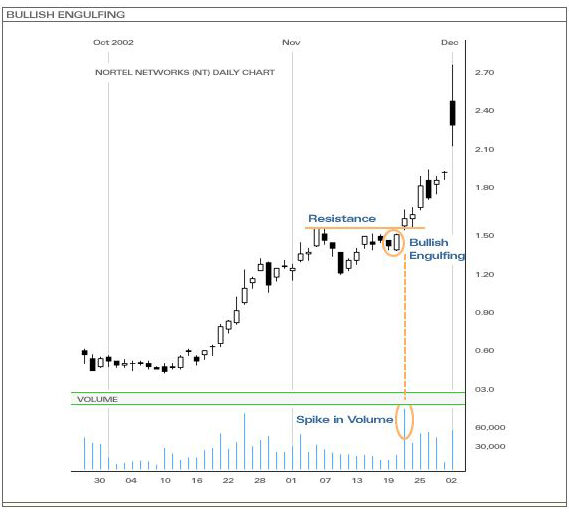

In the above example, the price was retesting the previous resistance and looked as if it had topped as two consecutive declining days were the result. Then the bullish engulfing pattern formed. The next day, the price gapped up at the open, on heavy volume, and thus confirmed the previous day’s bullish signal.

And as with most patterns, price action prior to and immediately after the bullish engulfing pattern needs to be analyzed for a confirmation for the bulls.

How to interpret and use the information in a bullish engulfing pattern:

When a bullish engulfing candlestick pattern is identified on a price chart, it may indicate that there is potential for a bullish trend reversal or continuation. However, it’s important to keep in mind that the pattern should be used in conjunction with other technical indicators and analysis to confirm the potential for future price movements.

Here are some steps to consider when interpreting future price movements based on a bullish engulfing candlestick pattern:

Look for the pattern: The first step is to identify the bullish engulfing candlestick pattern on a price chart. The pattern is characterized by a small bearish candlestick followed by a larger bullish candlestick that completely engulfs the previous candlestick.

Analyze the context: Consider the context of the pattern, such as the time frame of the chart, the volume of trading during the pattern, and the overall trend of the asset. The pattern is more significant if it occurs during a downtrend and is supported by high trading volume.

Look for confirmation: Look for confirmation of the pattern by observing other technical indicators such as moving averages, trend lines, and other candlestick patterns. A confirmation from other indicators can strengthen the potential for a bullish reversal or continuation.

Determine a price target: Use the height of the bullish candlestick to determine a potential price target. This is calculated by measuring the distance from the low of the bearish candlestick to the high of the bullish candlestick, and then adding that distance to the breakout level.

Manage risk: Always manage risk by setting stop-loss orders to protect against unexpected price movements in the opposite direction.

Remember that no single candlestick pattern can provide a definitive indication of future price movements. Traders should use bullish engulfing candlestick patterns in conjunction with other technical analysis tools and risk management strategies to make informed trading decisions.