MONTREAL, May 13, 2025 (GLOBE NEWSWIRE) — Aya Gold & Silver Inc. (TSX: AYA; OTCQX: AYASF) (“Aya” or the “Corporation”) today announced first quarter financial and operational results for the three-month period ended March 31, 2025. All amounts are in US dollars, unless otherwise stated.

Q1-2025 Highlights

- Silver production of 1,068,652 ounces (“oz”) in Q1-2025 compared to 366,362 oz in Q1-2024, a 192% increase.

- Ore processed increased to 249,743 tonnes (“t”), reaching record throughput levels, compared with 81,331t in Q1-2024, a 207% increase.

- Mine production increased to 194,661t, achieving an average mining rate of 2,163 tonnes per day (“tpd”), compared with 106,880t in Q1-2024, an 82% increase.

- Record revenues of $33.8 million (“M”), up 566% year-over-year, with an average net realized silver price of $31.87/oz.

- Operating cash flow of $7.9M, compared to a negative cash flow of $3.7M in Q1-2024.

- Cash cost per silver ounce sold decreased to $18.93/oz in Q1-2025 from $20.31/oz in Q1-2024.

- Net income of $6.9M, compared to a net loss of $2.6M in Q1-2024; diluted EPS of $0.05.

- Robust financial position with $37M in cash and restricted cash, compared to $49M as at December 31, 2024.i

- Accounts receivable of $11.6M as at March 31, 2025 compared to $1.8M as at December 31, 2024. Funds received in early Q2-2025 from sales that occurred in the last days of Q1-2025.

Ramp Up, Exploration and Development

- Successful ramp up of the new plant at the Zgounder Mine following the declaration of commercial production on December 29, 2024.

- Drilling activity included 2,916 (diamond drill hole (“DDH”)) meters (“m”) at Zgounder and 1,059m at Zgounder Regional.

- Boumadine drilling totaled 46,207m of combined DDH and reverse circulation (“RC”) drilling.

- Updated mineral resource estimate for Boumadine in February 2025.

Environmental, Social and Governance (“ESG”)

- Launched the 2024 data collection campaign with the aim of publishing Aya’s 2024 sustainability report in May 2025.

- Strengthened health and safety (“H&S”) processes through preventative measures, with 100% of incidents analyzed and 2,364 hours of training completed.

- Expanded tutoring programs at the high school in Talouine and the secondary school in Taouyalte.

- Began new community engagement inviting project proposals from local communities, entrepreneurs and cooperatives, which was developed in partnership with National Institute for Human Development.

Recent Developments

- Appointment of Mr. John Burzynski, a seasoned mine builder with deep technical expertise, to Aya’s Board of Directors.

- Completed strategic spinout of the Amizmiz gold project to Mx2 Mining Inc. on April 16, 2025.

- Received final approval for a $25M credit facility from EBRD, continuing the parities’ long-standing relationship, to support the development of Boumadine and to enhance financial flexibility as part of Aya’s growth strategy in Morocco.

“Aya delivered a standout quarter, achieving record silver production of over one million ounces, record revenues of $33.8 million, and operating cash flow of nearly $8 million — all while reducing cash costs and successfully ramping up operations inline with plans and only three months after commissioning the plant,” said Benoit La Salle, President and CEO of Aya Gold & Silver. “Our open-pit ramp up continues as planned, contributing to record plant throughput and supporting an increase in revenue and cash flow year-over-year.

“Operationally, we continue to see steady improvements, with a clear path to higher throughput and recovery rates aligned with long-term expectations. Backed by strong cash flow generation, improving cost performance, growing production, and a solid liquidity position, Aya is well-positioned to drive sustainable growth, maximize profitability, and deliver strong returns to shareholders.

“Importantly, we ended the quarter with $36.6 million in cash and restricted cash, excluding $11.6 million from silver sales made in Q1 and collected in early Q2—further strengthening our liquidity position. We also secured a $25 million credit facility from our long-standing partner EBRD — a clear vote of confidence in Aya’s long-term growth trajectory. This added liquidity allows us to accelerate development at Boumadine, while maintaining a strong balance sheet and funding future growth.”

Q1-2025 Highlights

Table 1 – Q1-2025 Operational Highlights

| Three-Month periods ended March 31 | |||||||

| Operational Highlights | 2025 | 2024 | Variance | ||||

| Ore Mined (tonnes) | 194,661 | 106,880 | 82 | % | |||

| Average Grade Mined (g/t Ag) | 151 | 159 | (5) | % | |||

| Ore Processed (tonnes) | 249,743 | 81,331 | 207 | % | |||

| Average Grade Processed (g/t Ag) | 163 | 173 | (6) | % | |||

| Combined Mill Recovery (%) | 82.4% | 81.8% | 0.6 | % | |||

| Milling Operations (tpd | 2,775 | 894 | 210 | % | |||

| Silver Ingots Produced (oz) | 1,011,173 | 111,497 | 807 | % | |||

| Silver in Concentrate Produced (oz) | 57,479 | 254,865 | (77) | % | |||

| Total Silver Produced (oz) | 1,068,652 | 366,362 | 192 | % | |||

| Silver Ingots Sold (oz) | 958,521 | 108,604 | 783 | % | |||

| Silver in Concentrate Sold (oz) | 103,044 | 129,662 | (21) | % | |||

| Total Silver Sales (oz) (A) | 1,061,565 | 238,266 | 346 | % | |||

| Avg. Net Realized Silver ($/oz) (B/A) | 31.87 | 21.31 | 50 | % | |||

| Cash Costs per Silver Ounce Soldii | 18.93 | 20.31 | (7) | % | |||

Table 2 – Q1-2025 Financial Highlights

| Three-Month periods ended March 31 | ||||||

| Financial Highlights | 2025 | 2024 | Variance | |||

| Revenues (B) | 33,831 | 5,077 | 566 | % | ||

| Cost of Sales | 23,584 | 4,741 | 397 | % | ||

| Gross Profit | 10,247 | 336 | 2,950 | % | ||

| Operating Income (Loss) | 3,328 | (2,869) | 216 | % | ||

| Net Income (Loss) | 6,930 | (2,592) | 367 | % | ||

| Operating Cash Flows | 7,893 | (3,736) | 311 | % | ||

| Shareholders | ||||||

| (Loss) Earnings per share – basic | 0.05 | (0.02) | NM | |||

| (Loss) Earnings per share – diluted | 0.05 | (0.02) | NM | |||

| March 31, | December 31, | |||||

| 2025 | 2024 | Variance | ||||

| Working Capitaliii | 1,752 | 23,424 | (98) | % | ||

| Cash | 18,319 | 30,944 | (41) | % | ||

| Accounts Receivable | 11,645 | 1,827 | 537 | % | ||

| Restricted Cash | 18,257 | 18,246 | 0.1 | % | ||

Operational Review

The first quarter 2025 was highlighted by the continuous ramp of the new mill, producing over one million ounces of silver during the quarter.

Throughput and mill availability were at or above target. Milling throughput averaged 2,775 tonnes per day with over 90% availability. Mill feed grade was at 163gpt and recovery was 82.4%, below the 89% target established in the feasibility study. Lower recovery was caused by low dissolved oxygen in the leaching tanks due to poor performance of the oxygen plant. The oxygen plant is currently being repaired. It is expected that recovery will improve once the oxygen plant is repaired and producing at the designed capacity.

The total mining rate for the quarter averaged 2,163 tpd, for a total of 194,661t of ore mined at a grade of 151 g/t Ag. The mill feed included stockpiled, underground, and open pit ore. Production at both mines is accelerating according to our ramp up plan. Stockpiles levels were at 281,290t at the end of the quarter. Mining rate will continue to increase during the year to reach 3,000tpd of ore, from both underground and open pit mines, by the end of 2025.

More specifically, 133,848t of ore was mined during the quarter from the open pit at an average grade of 155 g/t Ag. This included ore from transitional and oxide zones. The open-pit mine had a strip ratio of 13 during Q1-2025, which was lower than planned, as ore zones were preferentially mined. The open-pit mining rate was 20,891tpd of total material moved, compared with 15,360 tpd in Q4-2024 as per ramp up. In April 2025, additional mining equipment was added to the open-pit mining contractor’s fleet, increasing mining rate near 30,000 tpd of total material mined. With increasing mining capacity, the strip ratio will increase to continue developing the open pit, ensuring sustainable future production. By year end, the open-pit mining rate is planned to reach over 40,000 tpd of total material moved, reaching comfortably over 2,000tpd of ore from the open pit.

Exploration

Zgounder Near Mine and Regional

In Q1-2025, the Corporation drilled 2,916m of DDH on near-mine targets with the aim of defining at-depth and lateral mineralization. Initial results from the at-depth program outlined significant down-plunge extensions of the deposit with thick high-grade interceptions. Underground holes ZG-SF-24-203 and ZG-SF-24-259 intersected 911 g/t Ag over 10.0m and 1,082 g/t Ag over 8.5m, respectively, confirming mineralization at depth at the granite contact outside of the current resource boundary. Two underground rigs were mobilized with the aim of expanding mineral resources at depth.

In the quarter, drilling focused on targets west, near the major fault, and at depth towards the granite contact. Infill drilling, underground and surface, on the high-grade mineralization at the main ore body confirmed the mineralization and extended underground production zones.

In Q1-2025, a total of 1,059m of DDH were drilled on Zgounder Regional permits, part of the 10,000m budgeted for the 2025 regional drill program. In addition, detailed mapping and prospecting are being carried out on both Tourchkal and Zgounder Far East permits. Several high impact drill targets have been identified on these permits.

Boumadine

During the quarter, the Corporation drilled 39,600m DDH and 6,607m RC at Boumadine confirming continuity of the Boumadine deposit and extending the strike length of the Tizi Zone from 2.0 km to 2.2 km. New targets identified by the 2024 mapping and geophysical program were also drill tested. These results are pending.

An update to the mineral resources, based on 2024 drilling at Boumadine, was released on February 24, 2025, consisting of an Inferred Mineral Resource of 29.2Mt at 82g/t Ag, 2.63 g/t Au, 2.11% Zn and 0.82% Pb containing an estimated 76.8Moz of Ag, 2.4Moz of Au, 615 kt of Zn and 237 kt of Pb, representing 378Moz AgEq, an increase of 19%, and an Indicated Mineral Resource of 5.2Mt at 91 g/t Ag, 2.78 g/t Au, 2.8% Zn and 0.85% Pb containing an estimated 15.1Moz of Ag, 449koz of Au, 145 kt of Zn and 44 kt of Pb, representing 74.4Moz Silver equivalent (“AgEq”), an increase of 120%.

Table 3 – Boumadine Updated Mineral Resource Estimate (February 24, 2025)

| Cutoff | Tonnes | Average Grade | Contained Metal | |||||||||||||

| Ag | Au | Cu | Pb | Zn | AgEq | AuEq | Ag | Au | Cu | Pb | Zn | AgEq | AuEq | |||

| NSR US$/t | (kt) | (g/t) | (g/t) | (%) | (%) | (%) | (g/t) | (g/t) | (koz) | (koz) | (kt) | (kt) | (kt) | (koz) | (koz) | |

| Pit-constrained Indicated | 95 | 3,920 | 94 | 2.99 | 0.13 | 0.84 | 2.95 | 476 | 5.3 | 11,881 | 343 | 5 | 33 | 116 | 60,051 | 667 |

| Pit-constrained Inferred | 95 | 14,258 | 90 | 2.89 | 0.1 | 0.81 | 2.38 | 450 | 5 | 41,135 | 1,102 | 14 | 115 | 339 | 206,293 | 2,293 |

| Out-of-pit Indicated | 125 | 1,249 | 80 | 2.11 | 0.08 | 0.87 | 2.32 | 358 | 3.98 | 3,216 | 106 | 1 | 11 | 29 | 14,382 | 160 |

| Out-of-pit Inferred | 125 | 14,938 | 74 | 2.39 | 0.07 | 0.82 | 1.85 | 357 | 3.97 | 35,669 | 1,294 | 10 | 122 | 276 | 171,393 | 1,905 |

| Total Indicated | 95/ 125 | 5,169 | 91 | 2.78 | 0.12 | 0.85 | 2.8 | 448 | 4.98 | 15,097 | 449 | 6 | 44 | 145 | 74,433 | 827 |

| Total Inferred | 95/ 125 | 29,196 | 82 | 2.63 | 0.08 | 0.82 | 2.11 | 402 | 4.47 | 76,804 | 2,396 | 25 | 237 | 615 | 377,686 | 4,198 |

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. There is no certainty that Mineral Resources will be converted to Mineral Reserves.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources in this news release were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council, as may be amended from time to time.

- A silver price of US$24/oz with a process recovery of 89%, a gold price of US$2,200/oz with a process recovery of 85%, a zinc price of US$1.20/lb with a process recovery of 72%, a lead price of US$1.00/lb with a process recovery of 85%, and a copper price of US$4.00/lb with a process recovery of 75% were used in establishing the MRE.

- AgEq = Ag(g/t) + (Au(g/t) *Au price/oz*Au recovery)/(Ag price/oz*Ag recovery) + Zn(%)*Zn price/lb* Zn recovery/(Ag price/oz*Ag recovery)*685.7147973 + Pb(%)*Pb price/lb* Pb recovery/(Ag price/oz*Ag recovery)*685.7147973 + Cu(%)*Cu price/lb* Cu recovery/(Ag price/oz*Ag recovery)*685.7147973

- AuEq = Au(g/t) + (Ag(g/t) *Ag price/oz*Ag recovery)/(Au price/oz*Au recovery) + Zn(%)*Zn price/lb* Zn recovery/(Au price/oz*Au recovery)*685.7147973 + Pb(%)*Pb price/lb* Pb recovery/(Au price/oz*Au recovery)*685.7147973 + Cu(%)*Cu price/lb* Cu recovery/(Au price/oz*Au recovery)*685.7147973.

- The constraining pit optimization parameters were US$3.5/t for mineralized material mining. US$2/t for waste mining US$89/t for processing and US$6/t for G&A totalling US$95/t for a cut-off and 50-degree pit slopes.

- The out-of-pit parameters used a US$30/t mining cost, US$89/t processing cost and US$6/t G&A totalling US$125/t for a cut-off The out-of-pit Mineral Resource grade blocks were quantified above the US$125 NSR cut-off, below the constraining pit shell and within the constraining mineralized wireframes. Out–of-pit Mineral Resources exhibit continuity and reasonable potential for extraction by the long hole underground mining method.

- Individual calculations in tables and totals may not sum due to rounding of original numbers.

- Grade capping of 800 g/t Ag, 30 g/t Au, 28% Zn, 10% Pb and 1.4% Cu was applied to composites before grade estimation.

- Bulk density was evaluated separately for each individual vein with values ranging from 3.20 to 4.00 t/m3 determined from drill core samples and used for the MRE. For oxidized and transitional material, a bulk density of 2.65 t/m3 was used.

- 1.0 m composites were used during grade estimation.

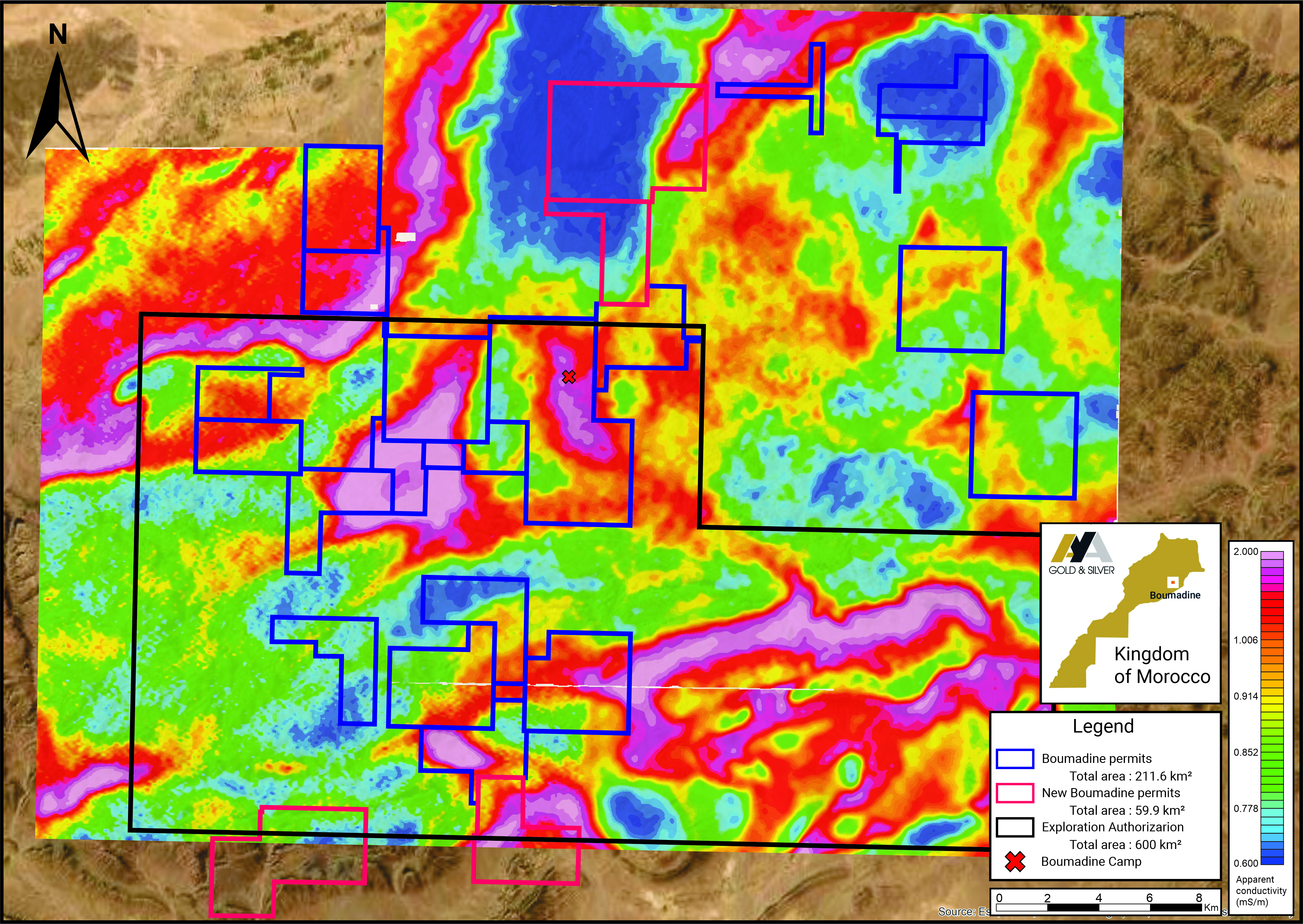

In Q1-2025, Aya continued to increase its Boumadine land holdings through the acquisition of four mining licenses, extending its land package to 272km2. In addition, the Corporation was granted a 600km2 authorization of exploration. Several high impact drill targets have been identified within these licenses and to the south within the exploration authorization area.

Figure 1 – Boumadine Permits Overlaying the Apparent Conductivity Airborne Regional Survey

Q1-2025 Conference Call Details

Aya will release its Q1-2025 earnings results on May 13, 2025 before market-open. Management will host a conference call on the same day at 10 a.m. Eastern Time to discuss the Corporation’s operational and financial results.

Webcast link: https://edge.media-server.com/mmc/p/48g2kxgq

Instructions for obtaining conference call dial-in numbers:

- Click on the following call link and complete the online registration form.

https://register-conf.media-server.com/register/BI84408f0b334445fd8c5977ae41b1dd02 - Upon registering you will receive the dial-in info and a unique PIN to join the call as well as an email confirmation with the details.

- Select a method for joining the call: a) Dial-In: A dial in number and unique PIN are displayed to connect directly from your phone; or b) Call Me: Enter your phone number and click “Call Me” for an immediate callback from the system. The call will come from a US number.

The live webcast will be archived and will be available for replay. Presentation slides that will accompany the conference call will also be posted on Aya’s website.

Qualified Person

The scientific and technical information contained in this press release have been reviewed and approved by David Lalonde, B. Sc, Vice-President of Exploration, and by Raphael Beaudoin, P. Eng, Vice-President, Operations, both of whom are a “Qualified Person” as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

About Aya Gold & Silver Inc.

Aya Gold & Silver Inc. is a rapidly growing, Canada-based silver producer with operations in the Kingdom of Morocco.

The only TSX-listed pure silver mining company, Aya operates the high-grade Zgounder Silver Mine and is exploring its properties along the prospective South-Atlas Fault, several of which have hosted past-producing mines and historical resources.

Aya’s management team has been focused on maximizing shareholder value by anchoring sustainability at the heart of its operations, governance, and financial growth plans.

For additional information, please visit Aya’s website at www.ayagoldsilver.com.

Or contact

| Benoit La Salle, FCPA, MBA President & CEO benoit.lasalle@ayagoldsilver.com | Alex Ball VP, Corporate Development & IR alex.ball@ayagoldsilver.com |

Forward-Looking Statements

This press release contains certain statements that constitute forward-looking information within the meaning of applicable securities laws (“forward-looking statements”), which reflects management’s expectations regarding Aya’s future growth and business prospects (including the timing and development of new deposits and the success of exploration activities) and other opportunities. Wherever possible, words such as “plan”, “improve”, “expectation”, “growing”, “accelerate”, “guidance”, “ongoing”, “focus”, “optimize”, “expect”, “maximize”, “pursue”, “similar”, “potential”, “improve”, “transition”, “objective”, “continue”, “target”, “prioritize”, and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will”, or are “likely” to be taken, occur or be achieved, have been used to identify such forward-looking information. Specific forward-looking statements in this press release include, but are not limited to, statements and information with respect to (1) Aya reaching milling nameplate capacity in early 2025; (2) optimization of Zgounder’s operations including improving recoveries as expected, repairing the oxygen plan in the expected timeline, and the reparation of the oxygen plant to impact recovery and help bring recoveries to the expected feasibility study levels, mining rates to increase as planned to reach over 40,000 tpd of total material moved; (3) Aya to complete an updated Technical Report in 2025; (4) maximization of profitability; (5) growth opportunities at both Zgounder and Boumadine; (6) Boumadine potential, namely statement to the effect that Boumadine is to reveal its potential in 2025; (7) Zgounder plant mining capacity to process ore at a steady rate of 3,000tpd in 2025; (8) mill recovery rate to reach the feasibility study recovery rate of 89% in 2025; (9) mill optimization; (10) potential for discovery of satellite deposits to the Zgounder Mine; (11) results from the geophysical and geochemical survey; (12) execution of the 2025 drilling program; (13) growing Boumadine mineralized footprint including through the multiple potentially parallel, on-trend conductive anomalies; (14) similarity to Boumadine of the multiple potentially parallel, on-trend conductive anomalies; (15) drilling of the Boumadine anomalies in 2025; (16) Aya’s guidance, namely the Corporation’s ability to attain 5.0 – 5.3 Moz Ag of annual production, a cash cost raging between $15.00 – $17.50/oz, a recovery of 84% – 88%, an average grade processed of 170 – 200 g/t Ag, and to deploy an exploration and development budget of 25 – 30 million dollars; (16) timing for ramp up of the Zgounder plant and optimization of its mining capacity rationalizing costs; (17) foreign exchange rate; (18) sales mix and product strategy, including only silver ingots to be produced and sold starting in Q2-2025; (19) results of the sales mix shift, including improvement to overall realized price for a given sales volume; (20) transition to a production strategy at Zgounder Mine to 1/3 underground and 2/3 open pit; (21) impacts of the shift to 1/3 underground and 2/3 open pit at Zgounder Mine on cost efficiency, margins, mining costs, and cash cost in 2025; (22) the completion of a mine plan in 2025 to support the shift in mining strategy at the Zgounder Mine plant; (23) the 2025 exploration program, namely the 2025 drilling program at Zgounder – near-mine and regional of 20,000m – 25,000m, and at Boumadine of 100,000m – 140-000m; (24) planned drilling campaign at Zgounder (near-mine) to follow up on the underground targets generated from the 2024 program; (25) finding satellite mineralization at Zgounder; (26) update of the mineral resources estimate for Zgounder later in 2025; (27) focus of the drilling at Boumadine, namely along the Main Trend and Tizi; (28) expending of the know mineralization trend along strike, at depth and to infill areas at Boumadine; (29) advancement of the preliminary economic assessment, which is targeted for 2026; (30) the greenfield exploration to test geological hypotheses and drill targets generated from the past three years of work; (31) Aya’s strategy and priorities with respect to Environment, Social and Governance. Such statements reflect the Corporation’s views as at the date of this press release and are subject to certain risks, uncertainties and assumptions, and undue reliance should not be placed on such statements. Although the forward-looking information contained in this press release reflect management’s current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, Aya cannot be certain that actual results will be consistent with such forward-looking information.

Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Corporation as of the date of such statements, are inherently subject to significant business, geological, economic and competitive uncertainties and contingencies. The material factors and assumptions used in the preparation of the forward-looking statements contained herein, which may prove to be incorrect, include, but are not limited to Aya’s capacity to execute on its plan, its capacity to achieve each item of its guidance, and those material factors and assumptions set forth in Corporation’s management’s discussion and analysis (“MD&A”) and the Corporation’s Annual Information Form (“AIF”) for the year ended December 31, 2024 available with Canadian securities regulators, as well as: (1) there being no significant disruptions affecting the operations of the Corporation, whether due to extreme weather events (including, without limitation drought, lack of rainfall) and other or related natural disasters, labour disruptions (including but not limited to strikes or workforce reductions), supply disruptions, power disruptions, damage to equipment, pit wall slides or otherwise; (2) permitting, development, operations and production from the Corporation’s operations and development projects being consistent with current expectations including, without limitation the maintenance of existing permits and approvals and the timely receipt of all permits and authorizations necessary for the operation of our assets; and the successful completion of exploration consistent with the Corporation’s expectations at the Corporation’s projects; (3) political and legal developments in any jurisdiction in which the Corporation operates being consistent with its current expectations including, without limitation, restrictions or penalties imposed, or actions taken, by any government, including but not limited to amendments to the mining laws in Morocco and Mauritania, potential third party legal challenges to existing permits; (4) the completion of studies, including scoping studies, preliminary economic assessments, pre-feasibility or feasibility studies, on the timelines currently expected and the results of those studies being consistent with our current expectations namely on the Boumadine project or resource updates on Zgounder; (5) the exchange rate between the Canadian dollar, the MAD, the Euro and the U.S. dollar being approximately consistent with current levels; (6) certain price assumptions for silver; (7) prices for diesel, fuel oil, electricity and other key supplies being approximately consistent with the Corporation’s expectations; (8) attributable production and cost of sales forecasts for the Corporation meeting expectations; (9) the accuracy of the current mineral reserve and mineral resource estimates of the Corporation’s analysis thereof being consistent with expectations (including but not limited to grade, ore tonnage and ore grade estimates), future mineral resource and mineral reserve estimates being consistent with preliminary work undertaken by the Corporation, mine plans for the Corporation’s current and future mining operations, and the Corporation’s internal models; (10) labour and materials costs increasing on a basis consistent with our current expectations; (11) the terms and conditions of the legal and fiscal stability in Morocco being interpreted and applied in a manner consistent with their intent and our expectations; (12) asset impairment potential; (13) the regulatory and legislative regime regarding mining in Morocco being consistent with our current expectations; (14) access to capital markets; (15) potential direct or indirect operational impacts resulting from infectious diseases or pandemics; (16) changes in national and local government legislation or other government actions; (17) litigation, regulatory proceedings and audits, and the potential ramifications thereof, being concluded in a manner consistent with the Corporation’s expectations, and (18) transactions announced by the Corporation, including the Mx2 spinoff advancing and closing per the Corporation’s timeline and expectations. For a more detailed discussion of such risks and other factors that may affect the Corporation’s ability to achieve the expectations set forth in the forward-looking statements contained in this press release, see the AIF and MD&A available on SEDAR+ at www.sedarplus.ca, as well as the Corporation’s other filings with the Canadian securities regulators.

Readers are advised and cautioned not to place undue reliance on forward-looking information. Except as required under applicable securities legislation, the Corporation undertakes no obligation to publicly update or revise forward-looking information, whether as a result of new information, future events or otherwise.

Notes to Investors Regarding the Use of Mineral Resources

Zgounder technical information on resources and reserve is based on technical report entitled “NI 43-101 TECHNICAL REPORT – FEASIBILITY STUDY ZGOUNDER EXPANSION PROJECT”, originally dated March 31, 2022, and amended on June 16, 2022 with an effective date of December 13, 2021 (the “Zgounder Report”) which was prepared under the supervision of Daniel M. Gagnon, DRA, with the participation of William Stone, Antoine Yassa, Jarita Barry, Fred Brown, Eugene Puritch, Daniel Morrison, André-François Gravel, Claude Bisaillon, Julie Gravel, Kathy Kalenchuk, Hugo Dello Sbarba, Philippe Rio Roberge, Richard Barbeau & Stephen Coatesall “qualified persons” for the purpose of the Zgounder Report.

Boumadine technical information is based on Aya’s press release of February 24, 2025. The mineral reserve and mineral resource estimates contained in this press release have been prepared in accordance with NI 43-101.

Mineral resources are reported exclusive of mineral reserves and as such the mineral resources do not have demonstrated economic viability. Numbers may not add or multiply accurately due to rounding. Inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is therefore no certainty that the conclusions of the initial exploration drilling results will be realized. Additionally, where the Corporation discusses exploration/expansion potential, any potential quantity and grade is conceptual in nature and there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource. Varying cut-off grades have been used depending on the mine, methods of extraction and type of ore contained in the reserves. Mineral resource metal grades and material densities have been estimated using industry-standard methods appropriate for each mineral project with support of various commercially available mining software packages. Additional details regarding mineral reserve and mineral resource estimation, classification, reporting parameters, key assumptions and associated risks for each of the Corporation’s mineral properties are provided in the respective NI 43-101 Technical Reports which are available at www.sedar.com and the Corporation’s website at www.ayagoldsilver.com.

Investors are cautioned not to assume that part or all of an inferred mineral resource exists, or is economically or legally mineable.

- Non-GAAP Measures, consisting of cash of $18,319 and restricted cash of $18,257 (December 31, 2024, balances of $30,944 and $18,246 respectively).

- Non-GAAP measures, refer to page 21 of Aya Gold & Silver’s Management and Discussion Analysis for the three-months ended March 31, 2025.

- Non-GAAP Measures, consisting of current assets of $73,268 less current liabilities of $71,516 (December 31, 2024, current assets of $76,540 less current liabilities of $53,116).

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e94c31fe-2d05-44ff-a6dc-72d11fb59357

- TEM Investor News: If You Have Suffered Losses in Tempus AI, Inc. (NASDAQ: TEM), You Are Encouraged to Contact The Rosen Law Firm About Your Rights - June 7, 2025

- Tulip Real Estate Acquires Premier London Hilton Property in £30 Million Deal from Lone Star - June 7, 2025

- Goldstein Patent Law Publishes Insights on How to Patent an Idea - June 7, 2025