Los Angeles, CA, May 05, 2025 (GLOBE NEWSWIRE) — BioSig Technologies, Inc. (NASDAQ: BSGM) (“BioSig” or the “Company”), a medical technology company is pleased to announce it has entered into a Letter of Intent (“LOI”) to enter into a proposed merger or other business combination (the “Merger”), with Streamex Exchange Corporation (“Streamex”) in an all-stock transaction, to bring a real-world asset tokenization company public on the Nasdaq.

Proposed Transaction Highlights include:

- Technology Stack – A fully developed and operational primary issuance and decentralized exchange infrastructure for on chain commodity markets.

- Commodity-focused real-world asset tokenization infrastructure and financing platform.

- Tokenization and financing infrastructure for streamlining the investment process, increasing capital availability for companies and opportunities for investors.

- Gain access to real-world assets with the ease and security of crypto. Diversify portfolios with tangible investments in a digital-first world.

Figure 1: The Streamex Ecosystem

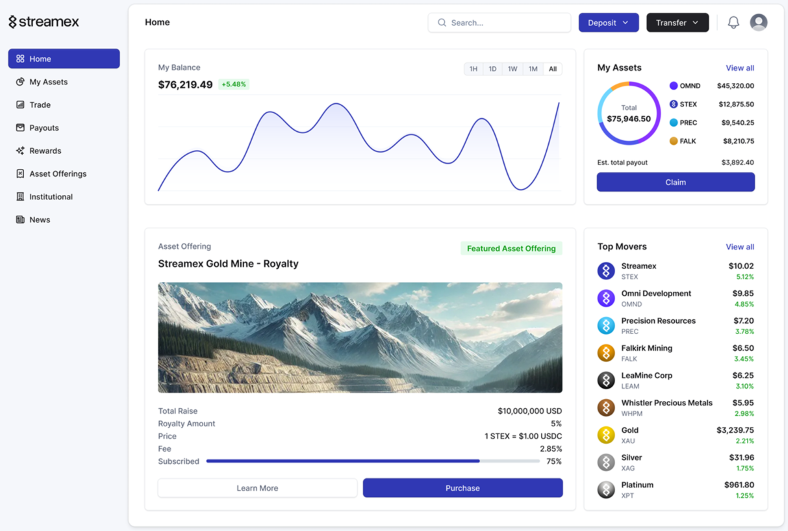

Figure 2: The Streamex Platform

About Streamex Exchange Corporation

Streamex is a real-world asset (RWA) tokenization company focused in the commodities space. With the goal to bring commodity markets on chain, Streamex has developed primary issuance and exchange infrastructure that will revolutionize commodity finance. Streamex is led by a group of highly successful and seasoned executives from financial, commodities and blockchain industries.

Streamex believes the future of finance lies in tokenization, innovative investment strategies, and decentralized markets. By merging advanced financial technologies with blockchain transparency, Streamex has created infrastructure and solutions that enhance liquidity, accessibility, and efficiency. Streamex’s goal is to bridge the gap between traditional finance and the digital economy, unlocking new opportunities for investors and institutions worldwide.

Co-Founders Henry McPhie and Morgan Lekstrom commented, “This is the next evolution of commodity and traditional finance; we are excited to bring to you a product that we believe can transform this legacy industry. In partnership with BioSig Technologies, we are working toward a definitive agreement to list Streamex on the Nasdaq. The world is rapidly moving towards digital and blockchain based financial markets. Billions in assets have already been tokenized and brought on chain by large financial institutions such as BlackRock, Goldman Sachs and HSBC. We at Streamex are excited to be first movers to bring the $2.1 Trillion mining and $142 Trillion global commodities market on chain though a streamlined and efficient platform powered by Solana.”

BioSig’s CEO, Anthony Amato added, “This merger represents a transformative opportunity for both our company and our shareholders. By joining forces with Streamex, we are unlocking significant growth potential while continuing to advance our existing business. This partnership will expand our market reach, enhance our capabilities, and create even greater opportunities for driving substantial returns. I am incredibly excited about the promising future ahead for our shareholders.”

Board and Management Changes Post Closing of the Proposed Transaction

- Appointment of a new Chief Executive Officer – Mr. Henry McPhie, Co-Founder and CEO of Streamex will lead the Company as Chief Executive Officer and member of the board of directors (the “Board”) through its next phase of growth.

- Appointment of a new Chairman – Mr. Morgan Lekstrom, Co-Founder and Chairman of Streamex will also join as Chairman of the Board.

- Founder of NexGold Mining Corp. (NEXG-TSX)

- CEO & Director of Premium Resources, which just recapitalized $67.8M (PREM-TSX)

- Current BioSig CEO and Chairman, Anthony Amato will remain on the Board.

- Additional Board members to be added post definitive agreement signing.

Strategic Advisor Additions Post Closing of the Proposed Transaction

- Mr. Frank Giustra has agreed to join as a Strategic Investor and Advisor on Commodities.

- Founder of LionsGate Films (LGF-NYSE, $2B)

- Founder of Wheaton Precious Metals, (WPM-NYSE, $37B)

- Founder of GoldCorp, acquired by Newmont (NEM, $57B)

- Mr. Mathew August has agreed to join as a Strategic Advisor on US Capital Markets.

- Executive Chairman of Atlas Capital Partners a New York, NY based single family office investment firm and merchant bank

- Active Venture Capitalist with significant investments within the Defense Tech, FinTech, Aerospace and other diversified industries

- Mr. Mitchell Williams has agreed to join as a Strategic Advisor on US Capital Markets.

- Managing Partner of a Private Investment Firm

- Former Senior Managing Director, Head of Public Markets at Wafra Inc.

- Former Sole Portfolio Manager of $4+ Billion at Oppenheimer Funds

- Mr. Frank Giustra has agreed to join as a Strategic Investor and Advisor on Commodities.

Proposed Terms of Merger

By signing the Letter of Intent, this potential transaction marks a distinct shift in a positive direction for existing BioSig shareholders.

- Immediately after the Merger, the current stockholders of Streamex will own approximately 19.9% of the outstanding Common Stock of the Company and a number of Series X Convertible Preferred Stock, par value $0.0001 per share (“Series X”), such that after taking into account the conversion of the Series X, the former stockholders of Streamex will own approximately 75% of the outstanding Common Stock of the Company, with the Company’s current stakeholders owning the remaining equity of the Company.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. For a discussion of other risks and uncertainties, and other important factors, any of which could cause BioSig’s actual results to differ from those contained in forward-looking statements, see BioSig’s filings with the Securities and Exchange Commission, including the section titled “Risk Factors” in BioSig’s Annual Report on Form 10-K, filed with the SEC on April 15, 2025. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise, except as required by law.

CONTACT: Todd Adler BioSig Technologies, Inc. Investor Relations 12424 Wilshire Blvd Ste 745 Los Angeles, CA 90025 tadler@biosigtech.com 203–409–5444, x104 Anthony Amato Chief Executive Officer aamato@biosigtech.com Henry McPhie Co-Founder & CEO of Streamex HenryM@Streamex.com https://www.streamex.com/ https://x.com/streamex

- StreetLeaf Plants its 10,000th Light in Advance of Hurricane Season - June 1, 2025

- Front-end Engineer Interview Preparation Course With AI 2025 Reviews – Interview Kickstart Trains AI-enabled Frontend Developers For FAANG Jobs - May 31, 2025

- ALL ENHANCES ITS ENTERTAINMENT OFFERING WITH INTERNATIONAL PARTNERSHIPS - May 31, 2025