The growth of the complicated urinary tract infections market is expected to be mainly driven by the entry of new therapies such as Tebipenem Pivoxil Hydrobromide (SPR994), ZAYNICH (zidebactam/cefepime, WCK 5222), Cefepime/Taniborbactam (VNRX-5133), Nacubactam (OP0595), and others with better clinical profiles, increased market penetration of targeted/advanced therapies, increased government funding, and awareness about the disease.

New York, USA, July 03, 2025 (GLOBE NEWSWIRE) — Complicated Urinary Tract Infections Market Set to Experience Stunning Growth During the Forecast Period (2025–2034) | DelveInsight

The growth of the complicated urinary tract infections market is expected to be mainly driven by the entry of new therapies such as Tebipenem Pivoxil Hydrobromide (SPR994), ZAYNICH (zidebactam/cefepime, WCK 5222), Cefepime/Taniborbactam (VNRX-5133), Nacubactam (OP0595), and others with better clinical profiles, increased market penetration of targeted/advanced therapies, increased government funding, and awareness about the disease.

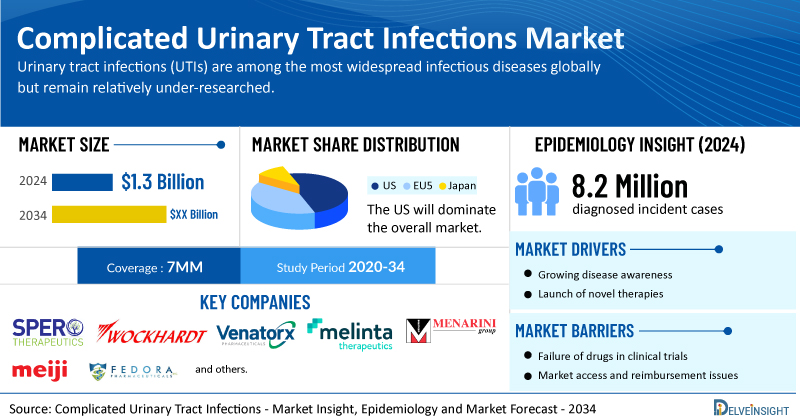

DelveInsight’s Complicated Urinary Tract Infections Market Insights report includes a comprehensive understanding of current treatment practices, emerging complicated urinary tract infections drugs, market share of individual therapies, and current and forecasted complicated urinary tract infections market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Complicated Urinary Tract Infections Market Report

- According to DelveInsight’s analysis, the total complicated urinary tract infections market size was USD 1.3 billion in 2024 in the 7MM.

- Among 7MM, the United States had the highest market size of cUTI in 2024, which accounts for approximately 50% of the total 7MM market.

- In 2024, there were 8.2 million diagnosed incident cases of cUTI in the 7MM. Additionally, in the same year, over 1 million diagnosed-incident cases of uUTI progressed to cUTI in the 7MM, which is expected to increase during the forecast period (2025–2024).

- Prominent companies, including Spero Therapeutics, Wockhardt, Venatorx Pharmaceuticals, Melinta Therapeutics, Menarini Group, Meiji Seika Pharma, Fedora Pharmaceuticals, and others, are actively working on innovative complicated urinary tract infection drugs.

- Some of the key complicated urinary tract infections therapies in the pipeline include Tebipenem Pivoxil Hydrobromide (SPR994), ZAYNICH (zidebactam/cefepime, WCK 5222), Cefepime/Taniborbactam (VNRX-5133), Nacubactam (OP0595), and others. These novel complicated urinary tract infection therapies are anticipated to enter the complicated urinary tract infections market in the forecast period and are expected to change the market.

- In March 2025, Meiji Seika Pharma announced that it had achieved positive results in a global Phase III clinical trial of OP0595, a novel ß-lactamase inhibitor developed to combat AMR. The trial targeted patients with cUTI or acute, uncomplicated pyelonephritis.

- In January 2025, Wockhardt announced that ZAYNICH demonstrated unprecedented efficacy in a global, pivotal Phase III study for cUTI, achieving a clinical cure rate of 96.8% and successfully meeting superiority criteria for registration.

Discover which complicated urinary tract infection medications are expected to grab the market share @ Complicated Urinary Tract Infections Market Report

Complicated Urinary Tract Infections Overview

Urinary tract infections (UTIs) are among the most widespread infectious diseases globally but remain relatively under-researched. While uropathogenic Escherichia coli (UPEC) is responsible for the majority of cases, the urinary tract can be infected by a range of bacterial species, each interacting uniquely with the bladder environment.

UTIs can vary significantly in severity, from mild, uncomplicated infections to more serious conditions such as complicated UTIs (cUTIs), pyelonephritis, and urosepsis, underscoring the need for accurate patient stratification. cUTIs tend to have higher risks of recurrence, chronic symptoms, and adverse outcomes, primarily driven by host-related factors rather than the infecting organism. These infections also frequently show high levels of antibiotic resistance.

Asymptomatic bacteriuria (ASB) is the most prevalent type of complicated urinary infection, particularly among patients with long-term catheter use, neurogenic bladder disorders, or elderly individuals in nursing homes. Symptomatic presentations can range from mild discomfort to life-threatening complications such as bacteremia and sepsis. Complete urinary obstruction or trauma, especially when accompanied by blood in the urine, is often linked to more severe disease. Diagnosing a cUTI typically involves a combination of clinical assessment, microbiological analysis, and imaging studies.

Complicated Urinary Tract Infections Epidemiology Segmentation

The complicated urinary tract infections epidemiology section provides insights into the historical and current complicated urinary tract infections patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The complicated urinary tract infections market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Diagnosed Incident Cases of cUTI

- Total Diagnosed Incident Cases of cUTI Progressed From uUTI

- Total Age-specific Cases of cUTI

- Total Pathogen-specific Cases of cUTI

- Total Treated Cases of cUTI

Download the report to understand which factors are driving complicated urinary tract infections epidemiology trends @ Complicated Urinary Tract Infections Treatment Algorithm

Complicated Urinary Tract Infections Treatment Market

A variety of medications are used for treatment, including beta-lactamase inhibitors, protein synthesis inhibitors, and others. In some cases, healthcare providers may recommend combination therapies or dietary supplements.

For hospitalized patients, broad-spectrum treatment regimens are typically used as empiric therapy. These may include extended-spectrum cephalosporins with or without an aminoglycoside, or combinations of a beta-lactam antibiotic with a beta-lactamase inhibitor (such as ampicillin-sulbactam, ticarcillin-clavulanate, or piperacillin-tazobactam).

Currently approved treatments for complicated urinary tract infections include RECARBRIO and ZERBAXA (Merck Sharp & Dohme), AVYCAZ (AbbVie/Pfizer), FETROJA (Shionogi), VABOMERE (Melinta Therapeutics), ZEMDRI (Cipla Therapeutics), and EXBLIFEP (Allecra Therapeutics).

RECARBRIO is a combination therapy that includes imipenem, an antibacterial from the penem class; cilastatin, an inhibitor of renal dehydropeptidase; and relebactam, a beta-lactamase inhibitor. ZERBAXA combines ceftolozane, a cephalosporin-class antibiotic, with tazobactam, a beta-lactamase inhibitor, and is approved for treating complicated urinary tract infections, including kidney infections.

FETROJA, a cephalosporin antibiotic, is indicated for adults aged 18 and above to treat infections caused by susceptible Gram-negative bacteria, such as cUTI and pyelonephritis. VABOMERE, which consists of meropenem and the beta-lactamase inhibitor vaborbactam, was approved by the FDA in August 2017 for adult patients with cUTI, including pyelonephritis due to certain bacteria. EXBLIFEP is a combination of cefepime, a fourth-generation cephalosporin, and enmetazobactam, an innovative extended-spectrum beta-lactamase inhibitor.

Learn more about the complicated urinary tract infections treatment options @ Complicated Urinary Tract Infections Treatment Guidelines

Complicated Urinary Tract Infections Emerging Drugs and Companies

Some of the drugs in the pipeline include tebipenem pivoxil hydrobromide, cefepime/zidebactam, and cefepime-Taniborbactam, among others.

Tebipenem HBr (tebipenem pivoxil hydrobromide; previously known as SPR994) is an orally administered antibiotic intended for treating complicated urinary tract infections and acute pyelonephritis (AP). It aims to minimize hospital admissions or facilitate patient discharge following intravenous (IV) antibiotic therapy. In March 2025, Spero Therapeutics, in partnership with GSK, initiated a pre-planned interim analysis of the ongoing Phase 3 PIVOT-PO trial evaluating tebipenem HBr. The outcome of this analysis is expected in Q2 2025.

WCK-5222 (cefepime/zidebactam) is a next-generation antibiotic that combines a novel β-lactam enhancer mechanism designed to counter the diverse and evolving β-lactamases that undermine even advanced β-lactam antibiotics. Zidebactam, a first-in-class β-lactam enhancer, robustly targets penicillin-binding protein 2 (PBP2) across key Gram-negative pathogens such as Pseudomonas aeruginosa, Acinetobacter baumannii, and Enterobacterales. This candidate is approaching the final stages of a global Phase III trial, aimed at supporting regulatory approval for treating adult patients with cUTIs or AP.

Cefepime-taniborbactam (VNRX-5133) is a combination of a β-lactam antibiotic and β-lactamase inhibitor, being developed by Venatorx Pharmaceuticals for infections such as cUTIs and hospital- or ventilator-associated bacterial pneumonia (HABP/VABP). In February 2024, Venatorx and Melinta Therapeutics disclosed that the FDA issued a Complete Response Letter (CRL) in response to their New Drug Application (NDA) for cefepime-taniborbactam. That same month, The New England Journal of Medicine (NEJM) published CERTAIN-1 Phase III trial results, which demonstrated that cefepime-taniborbactam outperformed meropenem in treating complicated UTIs, including AP, while maintaining a comparable safety profile.

The anticipated launch of these emerging complicated urinary tract infections therapies are poised to transform the complicated urinary tract infections market landscape in the coming years. As these cutting-edge complicated urinary tract infection therapies continue to mature and gain regulatory approval, they are expected to reshape the complicated urinary tract infections market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about new treatment for complicated urinary tract infections, visit @ Complicated Urinary Tract Infections Management

Complicated Urinary Tract Infections Market Dynamics

The complicated urinary tract infections market dynamics are anticipated to change in the coming years. Rising use of urinary catheters and other drainage devices, along with the growing demand for antibiotics, the only available treatment for cUTIs and UTIs, is expected to drive market growth, especially as catheter users are at higher risk of infection; however, the current lack of high-potency approved oral antibiotics highlights a significant opportunity, where the first-ever FDA approval for such drugs could offer a strong first-mover advantage, further supported by increasing mergers, acquisitions, and collaborations aimed at developing safer and more effective therapies.

Furthermore, many potential therapies are being investigated for the treatment of complicated urinary tract infections, and it is safe to predict that the treatment space will significantly impact the complicated urinary tract infections market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate is expected to drive the growth of the complicated urinary tract infections market in the 7MM.

However, several factors may impede the growth of the complicated urinary tract infections market. Currently, the treatment landscape for complicated urinary tract infections is limited by a lack of therapeutic options, rising treatment resistance, and inconsistent clinical guidelines, with conflicting recommendations between organizations creating confusion for providers; furthermore, the absence of consensus on appropriate therapy use and payer reluctance to reimburse costly drugs with modest efficacy further complicate effective disease management.

Moreover, complicated urinary tract infection treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the complicated urinary tract infections market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the unawareness about the disease may also impact the complicated urinary tract infections market growth.

| Complicated Urinary Tract Infections Report Metrics | Details |

| Study Period | 2020–2034 |

| Complicated Urinary Tract Infections Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Complicated Urinary Tract Infections Market Size | USD 1.3 Billion |

| Key Complicated Urinary Tract Infections Companies | Spero Therapeutics, Wockhardt, Venatorx Pharmaceuticals, Melinta Therapeutics, Menarini Group, Meiji Seika Pharma, Fedora Pharmaceuticals, Allecra Therapeutics, Merck Sharp & Dohme, AbbVie, Pfizer, Shionogi, Cipla Therapeutics, and others |

| Key Complicated Urinary Tract Infections Therapies | Tebipenem Pivoxil Hydrobromide (SPR994), ZAYNICH (zidebactam/cefepime, WCK 5222), Cefepime/Taniborbactam (VNRX-5133), Nacubactam (OP0595), EXBLIFEP, RECARBRIO, ZERBAXA, AVYCAZ/ZAVICEFTA, FETROJA/FETCROJA, VABOMERE, ZEMDRI, and others |

Scope of the Complicated Urinary Tract Infections Market Report

- Complicated Urinary Tract Infections Therapeutic Assessment: Complicated Urinary Tract Infections current marketed and emerging therapies

- Complicated Urinary Tract Infections Market Dynamics: Conjoint Analysis of Emerging Complicated Urinary Tract Infections Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Complicated Urinary Tract Infections Market Access and Reimbursement

Discover more about complicated urinary tract infection drugs in development @ Complicated Urinary Tract Infections Clinical Trials

Table of Contents

| 1 | Key Insights |

| 2 | Report Introduction |

| 3 | Complicated Urinary Tract Infection (cUTI) Market Overview at a Glance |

| 3.1 | Market Share (%) Distribution of cUTI by Country in 2024 in the 7MM |

| 3.2 | Market Share (%) Distribution of cUTI by Country in 2034 in the 7MM |

| 4 | Methodology |

| 5 | Executive Summary of Complicated Urinary Tract Infection (cUTI) |

| 6 | Key Events |

| 7 | Disease Background and Overview |

| 7.1 | Introduction |

| 7.2 | Classification of UTI |

| 7.3 | Signs and Symptoms of cUTIs |

| 7.4 | Risk Factors and Causes |

| 7.5 | Pathophysiology of cUTIs |

| 7.6 | Complications |

| 7.7 | Diagnosis of cUTIs |

| 7.7.1 | Diagnostic Guidelines for Complicated Urinary Tract Infection |

| 7.7.2 | Differential diagnosis (DDx) |

| 7.7.3 | Diagnostic Algorithum |

| 8 | Treatment and Management of cUTIs |

| 8.1 | Antibiotic resistance in cUTI |

| 8.2 | Treatment Guidelines for Complicated Urinary Tract Infection |

| 8.2.1 | The European Association of Urology (EAU) Guidelines for Treatment of cUTIs |

| 8.2.2 | NICE Guidelines for the management of cUTIs |

| 8.2.3 | IDSA 2024 Guidance on the Treatment of Antimicrobial Resistant Gram-Negative Infections |

| 8.3 | Treatment Algorithm for cUTI |

| 9 | Epidemiology and Patient Population |

| 9.1 | Key Findings |

| 9.2 | Assumptions and Rationale: The 7MM |

| 9.3 | Total Diagnosed Incident Cases of cUTI in 7MM |

| 9.4 | The United States |

| 9.4.1 | Total Diagnosed Incident Cases of cUTI in the United States |

| 9.4.2 | Age-specific Cases of cUTI in the United States |

| 9.4.3 | Gender-specific Cases of cUTI in the United States |

| 9.4.4 | Pathogen-specific Cases of cUTI in the United States |

| 9.4.5 | Total Treated Cases of cUTI in the United States |

| 9.5 | EU4 and the UK |

| 9.5.1 | Total Diagnosed Incident Cases of cUTI in EU4 and the UK |

| 9.5.2 | Age-specific Cases of cUTI in EU4 and the UK |

| 9.5.3 | Gender-specific Cases of cUTI in EU4 and the UK |

| 9.5.4 | Pathogen-specific Cases of cUTI in EU4 and the UK |

| 9.5.5 | Total Treated Cases of cUTI in EU4 and the UK |

| 9.6 | Japan |

| 9.6.1 | Total Diagnosed Incident Cases of cUTI in Japan |

| 9.6.2 | Age-specific Cases of cUTI in the Japan |

| 9.6.3 | Gender-specific Cases of cUTI in the Japan |

| 9.6.4 | Pathogen-specific Cases of cUTI in the Japan |

| 9.6.5 | Total Treated Cases of cUTI in the Japan |

| 10 | Patient Journey |

| 10.1 | Site of Care for patients with cUTI |

| 10.2 | Treatment Algorithm of cUTI |

| 10.3 | Proportion of patients that are multi-drug resistant & efficacy rate of drugs |

| 10.4 | Specialities involved in site of care |

| 11 | Marketed Therapies |

| 11.1 | Key Cross of Marketed Therapies |

| 11.2 | EXBLIFEP (Cefepime/Enmetazobactam): Allecra Therapeutics |

| 11.2.1 | Product Description |

| 11.2.2 | Regulatory Milestones |

| 11.2.3 | Clinical Developmental Activities |

| 11.2.4 | Safety and efficacy |

| 11.3 | RECARBRIO (imipenem, cilastatin, and relebactam): Merck Sharp & Dohme |

| 11.3.1 | Product Description |

| 11.3.2 | Regulatory Milestones |

| 11.3.3 | Other Developmental Activities |

| 11.3.4 | Safety and Efficacy |

| 11.4 | ZERBAXA (ceftolozane/tazobactam): Merck Sharp & Dohme |

| 11.4.1 | Product Description |

| 11.4.2 | Regulatory Milestones |

| 11.4.3 | Other Developmental Activities |

| 11.4.4 | Safety and Efficacy |

| 11.5 | AVYCAZ/ ZAVICEFTA (ceftazidime/avibactam): AbbVie/Pfizer |

| 11.5.1 | Product Description |

| 11.5.2 | Regulatory Milestones |

| 11.5.3 | Other Developmental Activities |

| 11.5.4 | Safety and Efficacy |

| 11.6 | FETROJA/FETCROJA (cefiderocol): Shionogi |

| 11.6.1 | Product Description |

| 11.6.2 | Regulatory Milestones |

| 11.6.3 | Other Developmental Activities |

| 11.6.4 | Safety and Efficacy |

| 11.7 | VABOMERE (meropenem/vaborbactam): Melinta Therapeutics |

| 11.7.1 | Product Description |

| 11.7.2 | Regulatory Milestones |

| 11.7.3 | Other Developmental Activities |

| 11.7.4 | Safety and Efficacy |

| 11.8 | ZEMDRI (plazomicin): Cipla Therapeutics |

| 11.8.1 | Product Description |

| 11.8.2 | Regulatory Milestones |

| 11.8.3 | Other Developmental Activities |

| 11.8.4 | Safety and Efficacy |

| 12 | Emerging Therapies |

| 12.1 | Key Cross Competition |

| 12.2 | Tebipenem Pivoxil Hydrobromide (SPR994): Spero Therapeutics |

| 12.2.1 | Product Description |

| 12.2.2 | Other Developmental Activities |

| 12.2.3 | Clinical Development |

| 12.2.4 | Safety and Efficacy |

| 12.2.5 | Analyst View |

| 12.3 | ZAYNICH (zidebactam/cefepime, WCK 5222): Wockhardt |

| 12.3.1 | Product Description |

| 12.3.2 | Other Developmental Activities |

| 12.3.3 | Clinical Development |

| 12.3.4 | Safety and Efficacy |

| 12.3.5 | Analyst View |

| 12.4 | Cefepime/Taniborbactam (VNRX-5133): Venatorx Pharmaceuticals/Melinta Therapeutics/Menarini Group |

| 12.4.1 | Product Description |

| 12.4.2 | Other Developmental Activities |

| 12.4.3 | Clinical Development |

| 12.4.4 | Safety and Efficacy |

| 12.4.5 | Analyst View |

| 12.5 | Nacubactam (OP0595): Meiji Seika Pharma/Fedora Pharmaceuticals |

| 12.5.1 | Product Description |

| 12.5.2 | Other Developmental Activities |

| 12.5.3 | Clinical Development |

| 12.5.4 | Analyst View |

| 13 | Complicated Urinary Tract Infection (cUTI) – Seven Major Market Analysis |

| 13.1 | Key Findings |

| 13.2 | Market Outlook |

| 13.3 | Conjoint Analysis |

| 13.4 | Key Market Forecast Assumptions |

| 13.5 | Market Size in the 7MM |

| 13.5.1 | Total Market Size of cUTI in the 7MM |

| 13.5.2 | Market Size of cUTI by Therapies in the 7MM |

| 13.6 | Market Size in the United States |

| 13.6.1 | Total Market Size of cUTI in the United States |

| 13.6.2 | Market Size of cUTI by Therapies in the United States |

| 13.7 | Market Size in EU4 and the UK |

| 13.7.1 | Total Market size of cUTI in EU4 and the UK |

| 13.7.2 | Market Size of cUTI by Therapies in EU4 and the UK |

| 13.8 | Market Size in Japan |

| 13.8.1 | Total Market Size of cUTI in Japan |

| 13.8.2 | Market size of cUTI by Therapies in Japan |

| 14 | KOL Views |

| 15 | SWOT Analysis |

| 16 | Unmet Needs |

| 17 | Market Access and Reimbursement |

| 17.1 | United States |

| 17.1.1 | Centre for Medicare and Medicaid Services (CMS) |

| 17.2 | EU4 and the UK |

| 17.2.1 | Germany |

| 17.2.2 | France |

| 17.2.3 | Italy |

| 17.2.4 | Spain |

| 17.2.5 | United Kingdom |

| 17.3 | Japan |

| 17.3.1 | MHLW |

| 17.4 | Reimbursement Scenario in the 7MM |

| 17.4.1 | Reimbursement Scenario in the US |

| 17.4.2 | Patient Access Programs |

| 17.4.3 | Key HTA decisions |

| 18 | Appendix |

| 18.1 | Bibliography |

| 19 | DelveInsight Capabilities |

| 20 | Disclaimer |

Related Reports

Complicated Urinary Tract Infections Pipeline

Complicated Urinary Tract Infections Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key cUTIs companies, including Spero Therapeutics, Iterum Therapeutics, Venatorx Pharmaceuticals, Inc., Nabriva Therapeutics, Allecra Therapeutics, Wockhardt, MerLion Pharmaceuticals, among others.

Uncomplicated Urinary Tract Infections Market

Uncomplicated Urinary Tract Infections Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key uUTIs companies including GlaxoSmithKline, Locus Biosciences, Inmunotek, among others.

Uncomplicated Urinary Tract Infections Pipeline

Uncomplicated Urinary Tract Infections Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key uUTIs companies, including GlaxoSmithKline, Locus Biosciences, Inmunotek, among others.

Urinary Tract Infections Pipeline

Urinary Tract Infections Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key UTIs companies, including Wockhardt, GlaxoSmithKline, Iterum Therapeutics, Spero Therapeutics, VenatoRx Pharmaceuticals, Helperby Therapeutics, Spexis, LUCA Biologics, Seed Health, Inc., Aelin Therapeutics, Omnix Medical, Inmunotek S.L., Sinovent Pty Ltd., Qilu Pharmaceuticals, Entasis Therapeutics, Adaptive Phage Therapeutics, Locus Biosciences, Nabriva Therapeutics, Utility Therapeutics, Zensun (Shanghai) Sci & Tech, Fedora Pharmaceuticals, Osel Inc., Evofem Biosciences, Enlivex, Fimbrion Therapeutics, Rebiotix, MerLion Pharmaceuticals, Allecra Therapeutics, Lakewood Amedex, Sumitomo Dainippon Pharma, Sihuan Pharmaceuticals, SuperTrans Medical, Asieris Pharmaceuticals, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Pharmaceutical Consulting Services

Healthcare Conference Coverage

Pipeline Assessment

Healthcare Licensing Services

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

CONTACT: Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com