As per DelveInsight’s estimates, among the 7MM, the US captured the highest market of high- and low-grade serous ovarian cancer of nearly USD 1,900 million in 2024, which is expected to increase due to the launch of emerging therapies.

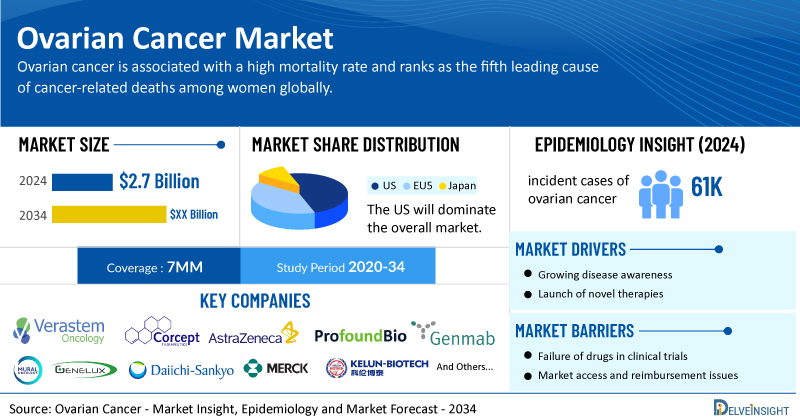

New York, USA, May 08, 2025 (GLOBE NEWSWIRE) — High- and Low-Grade Serous Ovarian Cancer Market is Predicted to Grow at a CAGR of 7.9% During the Study Period (2020–2034) | DelveInsight

As per DelveInsight’s estimates, among the 7MM, the US captured the highest market of high- and low-grade serous ovarian cancer of nearly USD 1,900 million in 2024, which is expected to increase due to the launch of emerging therapies.

DelveInsight’s Ovarian Cancer Market Insights report includes a comprehensive understanding of current treatment practices, emerging ovarian cancer drugs, market share of individual therapies, and current and forecasted ovarian cancer market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Ovarian Cancer Market Report

- In 2024, the total market size of ovarian cancer was USD 2.7 billion in the 7MM. The expected launch of potential therapies may increase the market size in the coming years.

- The HGSOC 1L and LGSOC 1L treatment market was nearly USD 1 billion and USD 3 million in 2024 in the 7MM.

- ELAHERE is one of the most rapidly adopted ADCs in the US oncology market. ELAHERE continues to show a promising launch trajectory for FR-alpha-positive platinum-resistant ovarian cancer. The revenue of ELAHERE in the United States was USD 470 million in 2024. In addition to this, commercialization is already underway in key overseas markets where AbbVie is accelerating regulatory and reimbursement timelines.

- There remains a significant unmet need in the treatment of low-grade serous ovarian cancer, with few companies actively targeting this area. Currently, TAFINLAR + MEKINIST stands as the only approved therapy for low-grade serous ovarian carcinoma. The market is set to expand with the expected approval for Avutometinib + Defactinib in 2025.

- In 2024, in the 7MM, there were around 61,400 incident cases of ovarian cancer. The majority of ovarian cancer cases were epithelial subtype (~90%).

- Prominent companies working in the domain of ovarian cancer, including Verastem Oncology, Corcept Therapeutics, AstraZeneca, ProfoundBio, Genmab, Mural Oncology, Genelux Corporation, Advenchen Laboratories, Daiichi Sankyo, Sutro Biopharma, Merck, Kelun-Biotech, and others, are actively working on innovative ovarian cancer drugs. These novel ovarian cancer therapies are anticipated to enter the ovarian cancer market in the forecast period and are expected to change the market.

- Some of the key ovarian cancer therapies in the pipeline include Avutometinib (VS-6766) + Defactinib (VS-6063), Relacorilant (CORT125134), IMFINZI (durvalumab), Rinatabart sesutecan (Rina-S), Nemvaleukin alfa (ALKS 4230), Olvimulogene nanivacirepvec (Olvi-Vec), Catequentinib (anlotinib/AL3818), Raludotatug deruxtecan (R-DXD/DS-6000A), Luveltamab tazevibulin (STRO-002), Sacituzumab tirumotecan, and others.

- In February 2025, the US FDA granted fast track designation to CUSP06, a CDH6-directed antibody-drug conjugate (ADC), for the treatment of patients with platinum-resistant ovarian cancer.

- In February 2025, Gradalis announced that the US FDA granted Regenerative Medicine Advanced Therapy (RMAT) designation for VIGIL for advanced ovarian cancer.

- In February 2025, pharmaand GmbH announced that long-term data for rucaparib in advanced ovarian cancer will be presented in a poster session during the European Society of Gynecological Oncology (ESGO) Annual Congress in Rome, Italy.

- In January 2025, Zentalis Pharmaceuticals was granted Fast Track Designation (FTD) for azenosertib for the treatment of patients with platinum-resistant Epithelial Ovarian Cancer (EOC), Fallopian Tube Cancer (FTC), or Primary Peritoneal Cancer (PPC) who are positive via Cyclin E1 immunohistochemistry for protein levels.

- In January 2025, Genmab anticipates the launch of Rina-S for 2L+ PROC in 2027 and the launch of 2L+ platinum-sensitive ovarian cancer in 2029. The company also anticipates the Phase II data and the update for the next steps in the upcoming months of 2025.

Discover which therapies are expected to grab the ovarian cancer market share @ Ovarian Cancer Market Report

Ovarian Cancer Overview

Ovarian cancer is associated with a high mortality rate and ranks as the fifth leading cause of cancer-related deaths among women globally. Although its exact cause remains unknown, lifestyle factors such as smoking, obesity, and poor dietary habits may contribute to the risk. A strong family history of breast or ovarian cancer significantly elevates susceptibility, particularly in individuals with BRCA1 or BRCA2 gene mutations.

Histologically, ovarian cancer is primarily epithelial in nature and is classified into five main subtypes: serous, clear cell, endometrioid, mucinous, and unspecified. These are further grouped into Type I and Type II tumors. Type I tumors, often linked to atypical proliferative lesions, are usually detected early and have a more favorable prognosis. In contrast, Type II tumors—such as high-grade serous ovarian carcinoma (HGSOC), carcinosarcoma, and undifferentiated carcinoma—are typically aggressive, high-grade malignancies believed to arise from serous tubal intraepithelial carcinoma. These are usually diagnosed at advanced FIGO stages and carry a poor prognosis.

Early detection of ovarian cancer is challenging due to the absence of specific symptoms in its initial stages. Nonetheless, persistent signs such as abdominal bloating, early satiety, frequent urination, pelvic or abdominal pain, digestive disturbances, irregular menstruation, fatigue, painful intercourse, and unexplained weight changes should prompt clinical evaluation, as they may signal the presence of the disease.

Ovarian Cancer Epidemiology Segmentation

The ovarian cancer epidemiology section provides insights into the historical and current ovarian cancer patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The ovarian cancer market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Incident Cases of Ovarian Cancer

- Age-specific Cases of Ovarian Cancer

- Type-specific Cases of Ovarian Cancer

- Stage-specific Cases of High- and Low-Grade Serous Ovarian Cancer

- Biomarker-specific Cases of High- and Low-Grade Serous Ovarian Cancer

Download the report to understand which factors are driving ovarian cancer epidemiology trends @ Ovarian Cancer Epidemiological Insights

Ovarian Cancer Treatment Market

Treatment strategies for ovarian cancer are typically tailored based on the cancer type, stage, and individual patient factors. Most patients undergo surgery to remove the tumor, but additional therapies may be necessary either before, after, or both before and after surgery. Standard treatment often includes a combination of surgery, chemotherapy, and targeted therapy.

For newly diagnosed ovarian cancer, the most effective drugs are platinum-based agents such as cisplatin or carboplatin, usually paired with a taxane like paclitaxel or docetaxel. Initial treatment often involves primary cytoreductive surgery (aimed at reducing tumor burden), followed by platinum-based chemotherapy. Alternatively, some patients may receive chemotherapy first (neoadjuvant therapy), followed by interval cytoreductive surgery and further chemotherapy.

However, the optimal first-line approach for low-grade serous ovarian carcinomas (LGSOCs) remains unclear. Some newly diagnosed patients may undergo chemotherapy followed by maintenance hormonal therapy, while others may receive hormonal therapy alone. Data from the National Cancer Database suggest that roughly 20% of patients with advanced-stage LGSOC do not receive adjuvant chemotherapy.

A major challenge for women with advanced-stage ovarian cancer is the high rate of recurrence after initial platinum-based chemotherapy. In addition, many patients eventually develop resistance to these treatments. Despite this, recent developments in therapies for recurrent ovarian cancer—such as angiogenesis inhibitors, PARP inhibitors, and immunotherapy—have shown promising outcomes. Although the role of PARP inhibitors in both newly diagnosed and recurrent cases is still under investigation, early results have been encouraging.

Learn more about the market of ovarian cancer @ Ovarian Cancer Treatment

Ovarian Cancer Emerging Drugs and Companies

Some of the drugs in the pipeline include Avutometinib + defactinib (Verastem Oncology), Relacorilant (Corcept Therapeutics), Sacituzumab Tirumotecan (Merck and Kelun-Biotech), IMFINZI (AstraZeneca), Rinatabart sesutecan (Genmab), Nemvaleukin alfa (Mural Oncology), and others.

Avutometinib is a RAF/MEK Clamp that forms inactive complexes with ARAF, BRAF, and CRAF, leading to comprehensive and sustained inhibition of the RAS pathway. This mechanism is designed to deliver a more robust and durable anti-tumor effect.

According to Verastem’s 2025 corporate presentation, the company plans to present further analyses from the RAMP 201 trial at a medical conference in Q1 2025, publish the primary results from the full RAMP 201 dataset, complete patient enrollment in the Phase III confirmatory RAMP 301 trial by year-end 2025, and share initial findings from the RAMP 201J Phase II study in Japan during the second half of 2025.

In December 2024, the FDA accepted and granted Priority Review for the New Drug Application (NDA) seeking approval of avutometinib in combination with defactinib for adult patients with recurrent low-grade serous ovarian cancer (LGSOC) who have received at least one prior systemic treatment and carry a KRAS mutation. The target action date under the Prescription Drug User Fee Act (PDUFA) is June 30, 2025.

Relacorilant is a selective cortisol modulator that specifically targets the glucocorticoid receptor (GR) without interacting with other hormone receptors in the body. Corcept Therapeutics is evaluating relacorilant across several serious conditions, including ovarian, adrenal, and prostate cancers, as well as Cushing’s syndrome. According to the company’s 2025 presentation, results from the Phase III ROSELLA trial are expected in the first quarter of 2025.

Sac-TMT is an experimental ADC composed of three key elements: 1) sacituzumab, a monoclonal antibody that targets TROP2, 2) a cytotoxic agent from the topoisomerase 1 inhibitor class, and 3) a novel, hydrolyzable yet irreversible linker that connects the antibody to the payload using proprietary conjugation technology. The therapy is currently being evaluated in a Phase III clinical trial for platinum-sensitive recurrent ovarian cancer.

The other pipeline therapies for ovarian cancer include

- Olvimulogene nanivacirepvec (Olvi-Vec): Genelux Corporation

- Catequentinib (anlotinib/AL3818): Advenchen Laboratories

- Raludotatug deruxtecan (R-DXD/DS-6000A): Daiichi Sankyo and Merck

- Luveltamab tazevibulin (STRO-002): Sutro Biopharma

- Sacituzumab tirumotecan: Merck and Kelun-Biotech

The anticipated launch of these emerging therapies are poised to transform the ovarian cancer market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the ovarian cancer market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about ovarian cancer clinical trials, visit @ Ovarian Cancer Treatment Drugs

Ovarian Cancer Market Dynamics

The ovarian cancer market dynamics are anticipated to change in the coming years. PARP inhibitors have become a cornerstone in ovarian cancer maintenance therapy, particularly in first-line (1L) and recurrent settings, offering substantial clinical benefits for patients with BRCA mutations and homologous recombination deficiency (HRD)-positive tumors. The recent approval of ELAHERE—the first ADC for ovarian cancer—has paved the way for further innovation, encouraging key players like Sutro Biopharma, ProfoundBio/Genmab, and Daiichi Sankyo/Merck to accelerate their ADC development programs in this space.

Additionally, investigational agents like CBX-12 show promise in broadening treatment options, especially for patients who are ineligible for antigen-targeted therapies such as monoclonal antibodies and ADCs. CBX-12 also holds potential for use in combination regimens with other anti-cancer agents, including immunotherapies, potentially enhancing treatment efficacy and expanding its clinical utility.

While many companies are focusing on platinum-resistant ovarian cancer (PROC), a significant untapped opportunity exists in targeting platinum-sensitive ovarian cancer. With more than 50% of second-line (2L) patients falling into this category, effective non-chemotherapy alternatives could fulfill a critical need and reshape the treatment landscape in this underserved population.

Furthermore, many potential therapies are being investigated for the treatment of ovarian cancer, and it is safe to predict that the treatment space will significantly impact the ovarian cancer market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate is expected to drive the growth of the ovarian cancer market in the 7MM.

However, several factors may impede the growth of the ovarian cancer market. Despite initial responsiveness to platinum-based therapies, a significant challenge in advanced ovarian cancer is the high relapse rate—approximately 70–80% of patients eventually develop platinum-resistant disease, drastically narrowing the range of effective treatment options. While PARP inhibitors have played a pivotal role in extending survival, concerns over long-term hematologic toxicities, such as myelodysplastic syndrome and acute myeloid leukemia, have dampened enthusiasm for their use in homologous recombination proficient (HRP) patients.

Meanwhile, the emergence of next-generation ADCs such as Luveltamab tazevibulin and Rinatabart sesutecan is reshaping the treatment landscape. These agents, targeting PROC in the second-line (2L) and later settings, pose direct competition to ELAHERE. With the potential for use in earlier lines of therapy, they may challenge ELAHERE’s market share by offering expanded utility and differentiated clinical benefits.

However, access to these novel therapies remains a key hurdle. Limited insurance coverage, especially in cost-sensitive regions, could significantly restrict patient access and slow the adoption of new treatments, underscoring the need for pricing strategies and value-based care models that ensure broader accessibility.

Moreover, ovarian cancer treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the ovarian cancer market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the unawareness about the disease may also impact the ovarian cancer market growth.

| Ovarian Cancer Report Metrics | Details |

| Study Period | 2020–2034 |

| Ovarian Cancer Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Ovarian Cancer Market Size in 2024 | USD 2.7 Billion |

| High- and Low-Grade Serous Ovarian Cancer Market CAGR | 7.9% |

| Key Ovarian Cancer Companies | Verastem Oncology, Corcept Therapeutics, AstraZeneca, ProfoundBio, Genmab, Mural Oncology, Genelux Corporation, Advenchen Laboratories, Daiichi Sankyo, Sutro Biopharma, Merck, Kelun-Biotech, pharma& GmbH, GlaxoSmithKline, AbbVie, Eli Lilly, Novartis, Roche, Genentech, Chugai, and others |

| Key Ovarian Cancer Therapies | Avutometinib (VS-6766) + Defactinib (VS-6063), Relacorilant (CORT125134), IMFINZI (durvalumab), Rinatabart sesutecan (Rina-S), Nemvaleukin alfa (ALKS 4230), Olvimulogene nanivacirepvec (Olvi-Vec), Catequentinib (anlotinib/AL3818), Raludotatug deruxtecan (R-DXD/DS-6000A), Luveltamab tazevibulin (STRO-002), Sacituzumab tirumotecan, RUBRACA, ZEJULA, LYNPARZA, ELAHERE, KEYTRUDA, JEMPERLI, RETEVMO/RETSEVMO, ENHERTU, TAFINLAR + MEKINIST, ROZLYTREK, and others |

Scope of the Ovarian Cancer Market Report

- Ovarian Cancer Therapeutic Assessment: Ovarian Cancer current marketed and emerging therapies

- Ovarian Cancer Market Dynamics: Conjoint Analysis of Emerging Ovarian Cancer Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Ovarian Cancer Market Access and Reimbursement

Discover more about ovarian cancer drugs in development @ Ovarian Cancer Clinical Trials

Table of Contents

| 1 | KEY INSIGHTS |

| 2 | REPORT INTRODUCTION |

| 3 | EXECUTIVE SUMMARY |

| 4 | KEY EVENTS |

| 5 | EPIDEMIOLOGY AND MARKET FORECAST METHODOLOGY |

| 6 | HIGH-GRADE AND LOW-GRADE SEROUS OVARIAN CANCER MARKET OVERVIEW AT A GLANCE IN THE 7MM |

| 6.1 | Market Share (%) Distribution by Line of Therapies in 2020 |

| 6.2 | Market Share (%) Distribution by Line of Therapies in 2034 |

| 6.3 | Market Share Distribution by Grade in 2020 |

| 6.4 | Market Share Distribution by Grade in 2034 |

| 7 | DISEASE BACKGROUND AND OVERVIEW |

| 7.1 | Introduction |

| 7.2 | Signs and Symptoms of Ovarian Cancer |

| 7.3 | Risk Factors and Causes of Ovarian Cancer |

| 7.4 | Classification of Ovarian Cancer |

| 7.5 | Pathogenesis of Ovarian Cancer |

| 7.6 | Complications |

| 7.7 | Diagnosis of Ovarian Cancer |

| 7.7.1 | Staging of Ovarian Cancer |

| 7.7.2 | Diagnostic Guidelines |

| 7.8 | Treatment |

| 7.8.1 | Local treatment |

| 7.8.2 | Systemic Treatments |

| 7.8.3 | Common Approaches |

| 7.9 | Guidelines |

| 7.9.1 | ESGO–ESMO–ESP Consensus Conference Recommendations on Ovarian Cancer: Pathology and Molecular Biology and Early, Advanced and Recurrent Disease (2024) |

| 7.9.2 | British Gynecological Cancer Society (BGCS) Ovarian, Tubal, and Primary Peritoneal Cancer Guidelines: Recommendations for Practice Update (2024) |

| 7.9.3 | NCCN Guidelines Ovarian Cancer |

| 7.9.4 | Current Treatment Strategies for Ovarian Cancer in the East Asian Gynecologic Oncology Trial Group (EAGOT) (2024) |

| 8 | EPIDEMIOLOGY AND PATIENT POPULATION OF 7MM |

| 8.1 | Key Findings |

| 8.2 | Assumptions and Rationale |

| 8.3 | Total Incident Cases of Ovarian Cancer in the 7MM |

| 8.4 | The United States |

| 8.4.1 | Total Incident Cases of Ovarian Cancer in the US |

| 8.4.2 | Age-specific Cases of Ovarian Cancer in the US |

| 8.4.3 | Type-specific Cases of Ovarian Cancer in the US |

| 8.4.4 | Stage-specific Cases of High- and Low-Grade Serous Ovarian Cancer in the US |

| 8.4.5 | Biomarker-specific Cases of Low-Grade Serous Ovarian Cancer in the US |

| 8.5 | EU4 and the UK |

| 8.5.1 | Total Incident Cases of Ovarian Cancer in EU4 and the UK |

| 8.5.2 | Age-specific Cases of Ovarian Cancer in EU4 and the UK |

| 8.5.3 | Type-specific Cases of Ovarian Cancer in EU4 and the UK |

| 8.5.4 | Stage-specific Cases of Low-Grade Serous Ovarian Cancer in EU4 and the UK |

| 8.5.5 | Biomarker-specific Cases of Low-Grade Serous Ovarian Cancer in EU4 and the UK |

| 8.6 | Japan |

| 8.6.1 | Total Incident Cases of Ovarian Cancer in Japan |

| 8.6.2 | Age-specific Cases of Ovarian Cancer in Japan |

| 8.6.3 | Type-specific Cases of Ovarian Cancer in Japan |

| 8.6.4 | Stage-specific Cases of Low-Grade Serous Ovarian Cancer in Japan |

| 8.6.5 | Biomarker-specific Cases of Low-Grade Serous Ovarian Cancer in Japan |

| 9 | PATIENT JOURNEY |

| 10 | MARKETED DRUGS |

| 10.1 | Key Cross Competition |

| 10.2 | RUBRACA (rucaparib): pharma& GmbH |

| 10.2.1 | Product Description |

| 10.2.2 | Regulatory Milestones |

| 10.2.3 | Other Developmental Activities |

| 10.2.4 | Clinical Development Activities |

| 10.2.5 | Safety and Efficacy |

| 10.3 | ZEJULA (niraparib): GlaxoSmithKline |

| 10.3.1 | Product Description |

| 10.3.2 | Regulatory Milestones |

| 10.3.3 | Other Developmental Activities |

| 10.3.4 | Clinical Development Activities |

| 10.3.5 | Safety and Efficacy |

| 10.4 | LYNPARZA (olaparib): AstraZeneca/Merck |

| 10.4.1 | Product Description |

| 10.4.2 | Regulatory Milestones |

| 10.4.3 | Other Developmental Activities |

| 10.4.4 | Clinical Development Activities |

| 10.4.5 | Safety and Efficacy |

| 10.5 | ELAHERE (mirvetuximab soravtansine): Abbvie |

| 10.5.1 | Product Description |

| 10.5.2 | Regulatory Milestones |

| 10.5.3 | Other Developmental Activities |

| 10.5.4 | Clinical Development Activities |

| 10.5.5 | Safety and Efficacy |

| 10.6 | KEYTRUDA (pembrolizumab): Merck |

| 10.6.1 | Product Description |

| 10.6.2 | Regulatory Milestones |

| 10.6.3 | Other Developmental Activities |

| 10.6.4 | Clinical Development Activities |

| 10.6.5 | Safety and Efficacy |

| 10.7 | JEMPERLI (dostarlimab): GlaxoSmithKline |

| 10.7.1 | Product Description |

| 10.7.2 | Regulatory Milestones |

| 10.7.3 | Other Developmental Activities |

| 10.7.4 | Clinical Development Activities |

| 10.7.5 | Safety and Efficacy |

| 10.8 | RETEVMO/RETSEVMO (selpercatinib): Eli Lilly |

| 10.8.1 | Product Description |

| 10.8.2 | Regulatory Milestones |

| 10.8.3 | Other Developmental Activities |

| 10.8.4 | Clinical Development Activities |

| 10.8.5 | Safety and Efficacy |

| 10.9 | ENHERTU (trastuzumab deruxtecan): Daiichi Sankyo |

| 10.9.1 | Product Description |

| 10.9.2 | Regulatory Milestones |

| 10.9.3 | Other Developmental Activities |

| 10.9.4 | Clinical Development Activities |

| 10.9.5 | Safety and Efficacy |

| 10.10 | TAFINLAR (dabrafenib) + MEKINIST (trametinib): Novartis |

| 10.10.1 | Product Description |

| 10.10.2 | Regulatory Milestones |

| 10.10.3 | Other Developmental Activities |

| 10.10.4 | Safety and Efficacy |

| 10.11 | ROZLYTREK (entrectinib): Roche/Genentech/Chugai |

| 10.11.1 | Product Description |

| 10.11.2 | Regulatory Milestones |

| 10.11.3 | Other Developmental Activities. |

| 10.11.4 | Clinical Development Activities |

| 10.11.5 | Safety and Efficacy |

| 11 | EMERGING DRUGS |

| 11.1 | Emerging Key Competitors |

| 11.2 | Safety and Efficacy Data of Phase II Emerging Drugs |

| 11.3 | Avutometinib (VS-6766) + Defactinib (VS-6063): Verastem Oncology |

| 11.3.1 | Product Description |

| 11.3.2 | Other Developmental Activities |

| 11.3.3 | Clinical Development |

| 11.3.4 | Safety and Efficacy |

| 11.3.5 | Analyst Views |

| 11.4 | Relacorilant (CORT125134): Corcept Therapeutics |

| 11.4.1 | Product Description |

| 11.4.2 | Other Development Activities |

| 11.4.3 | Clinical Development |

| 11.4.4 | Safety and Efficacy |

| 11.4.5 | Analyst Views |

| 11.5 | IMFINZI (durvalumab): AstraZeneca |

| 11.5.1 | Product Description |

| 11.5.2 | Other Developmental Activities |

| 11.5.3 | Clinical Development |

| 11.5.4 | Safety and Efficacy |

| 11.5.5 | Analyst Views |

| 11.6 | Rinatabart sesutecan (Rina-S): ProfoundBio/ Genmab |

| 11.6.1 | Product Description |

| 11.6.2 | Other Developmental Activities |

| 11.6.3 | Clinical Development |

| 11.6.4 | Safety and Efficacy |

| 11.6.5 | Analyst Views |

| 11.7 | Olvimulogene nanivacirepvec (Olvi-Vec): Genelux Corporation |

| 11.7.1 | Product Description |

| 11.7.2 | Other Developmental Activities |

| 11.7.3 | Clinical Development |

| 11.7.4 | Safety and Efficacy |

| 11.7.5 | Analyst Views |

| 11.8 | Nemvaleukin alfa (ALKS 4230): Mural Oncology |

| 11.8.1 | Product Description |

| 11.8.2 | Other Developmental Activities |

| 11.8.3 | Clinical Development |

| 11.8.4 | Safety and Efficacy |

| 11.8.5 | Analyst Views |

| 11.9 | Catequentinib (anlotinib/AL3818): Advenchen Laboratories |

| 11.9.1 | Product Description |

| 11.9.2 | Clinical Development |

| 11.9.3 | Safety and Efficacy |

| 11.9.4 | Analyst Views |

| 11.10 | Raludotatug deruxtecan (R-DXD/DS-6000A): Daiichi Sankyo and Merck |

| 11.10.1 | Product Description |

| 11.10.2 | Other Developmental Activities |

| 11.10.3 | Clinical Development |

| 11.10.4 | Safety and Efficacy |

| 11.10.5 | Analyst Views |

| 11.11 | Luveltamab tazevibulin (STRO-002): Sutro Biopharma |

| 11.11.1 | Product Description |

| 11.11.2 | Other Developmental Activities |

| 11.11.3 | Clinical Development |

| 11.11.4 | Safety and Efficacy |

| 11.11.5 | Analyst Views |

| 11.11 | Sacituzumab tirumotecan: Merck and Kelun-Biotech |

| 11.11.1 | Product Description |

| 11.11.2 | Other Developmental Activities |

| 11.11.3 | Clinical Development |

| 11.11.4 | Safety and Efficacy |

| 11.11.5 | Analyst Views |

| 12 | HIGH- AND LOW-GRADE SEROUS OVARIAN CANCER: 7MM |

| 12.1 | Key Findings |

| 12.2 | Total Market Size of High- and Low-Grade Serous Ovarian Cancer in the 7MM |

| 12.3 | Market Outlook |

| 12.4 | Conjoint Analysis |

| 12.5 | Key Market Forecast Assumptions |

| 12.6 | The United States |

| 12.6.1 | Total Market Size of High- and Low-grade Serous Ovarian Cancer in the US |

| 12.6.2 | Market Size of High- and Low-Grade Serous Ovarian Cancer by Therapies in the US |

| 12.7 | EU4 AND THE UK |

| 12.7.1 | Total Market Size of High- and Low-Grade Serous Ovarian Cancer in EU4 and the UK |

| 12.7.2 | Market Size of High- and Low-grade Serous Ovarian Cancer by Therapies in EU4 and the UK |

| 12.8 | JAPAN |

| 12.8.1 | Total Market Size of High- and Low-Grade Serous Ovarian Cancer in Japan |

| 12.8.2 | The Market Size of High- and Low-Grade Serous Ovarian Cancer by Therapies in Japan |

| 13 | Unmet Needs |

| 14 | SWOT Analysis |

| 15 | KOL Views |

| 16 | Market Access and Reimbursement |

| 16.1 | United States |

| 16.1.1 | Centre for Medicare and Medicaid Services (CMS) |

| 16.2 | EU4 and the UK |

| 16.2.1 | Germany |

| 16.2.2 | France |

| 16.2.3 | Italy |

| 16.2.4 | Spain |

| 16.2.5 | United Kingdom |

| 16.3 | Japan |

| 16.3.1 | MHLW |

| 16.4 | Market Access and Reimbursement of Ovarian Cancer |

| 16.4.1 | United States: Assistance Programs |

| 16.4.2 | United Kingdom: The National Institute for Health and Care Excellence (NICE) Recommendations |

| 16.4.3 | Germany: The Federal Joint Committee (G-BA) Resolutions |

| 16.4.4 | France: Haute Autorité de Santé (HAS) opinions |

| 16.4.5 | Italy: Italian Medicines Agency (AIFA) assessment |

| 16.4.6 | Spain: The Spanish Agency for Medicines and Health Products (AEMPS) Benefit Assessment |

| 16.4.7 | Japan |

| 17 | APPENDIX |

| 17.1 | Bibliography |

| 17.2 | Report Methodology |

| 18 | DELVEINSIGHT CAPABILITIES |

| 19 | DISCLAIMER |

| 20 | ABOUT DELVEINSIGHT |

Related Reports

Ovarian Cancer Epidemiology Forecast

Ovarian Cancer Epidemiology Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted ovarian cancer epidemiology in the 7MM, i.e., the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan.

Ovarian Cancer Pipeline

Ovarian Cancer Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key ovarian cancer companies, including Allarity Therapeutics, OSE Immunotherapeutic, Cristal Therapeutics, Bristol-Myers Squibb, Ono Pharmaceuticals, Merck & Co., Aravive Biologics, Mersana Therapeutics, Clovis Oncology, Verastem Oncology, Gradalis, AbbVie, Elevation oncology, OncoQuest Pharmaceuticals (CanariaBio), Alkermes, Hoffman-la Roche, AstraZeneca, MSD, GlaxoSmithKline, IMV, Corcept Therapeutics, among others.

Platinum-Resistant Relapsed Ovarian Cancer Market

Platinum-Resistant Relapsed Ovarian Cancer Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key platinum-resistant relapsed ovarian cancer companies, including Merck, Pfizer, AstraZeneca, ImmunoGen, Innovent Biologics, among others.

Advanced Recurrent Ovarian Cancer Market

Advanced Recurrent Ovarian Cancer Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key advanced recurrent ovarian cancer companies, including OncoQuest, Allarity Therapeutics, AstraZeneca, Jiangxi Qingfeng Pharmaceutical Co. Ltd., CSPC ZhongQi Pharmaceutical Technology Co., Ltd., Ellipses Pharma, Merck KGaA, Pfizer, Jiangsu HengRui Medicine Co., Ltd., Puma Biotechnology, Inc., Bayer, Chia Tai Tianqing Pharmaceutical Group Co., Ltd., Daiichi Sankyo, Inc., Astellas Pharma Inc, among others.

Advanced Ovarian Cancer Pipeline

Advanced Ovarian Cancer Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key advanced ovarian cancer companies, including OncoQuest, Allarity Therapeutics, AstraZeneca, Jiangxi Qingfeng Pharmaceutical Co. Ltd., CSPC ZhongQi Pharmaceutical Technology Co., Ltd., Ellipses Pharma, Merck KGaA, Pfizer, Jiangsu HengRui Medicine Co., Ltd., Puma Biotechnology, Inc., Bayer, Chia Tai Tianqing Pharmaceutical Group Co., Ltd., Daiichi Sankyo, Inc., Astellas Pharma Inc, among others.

Oncology Conference Coverage Services

DelveInsight’s Oncology Conference Coverage Services offer a thorough analysis of outcomes from major events like ASCO, ESMO, ASH, AACR, ASTRO, SOHO, SITC, the European CAR T-cell Meeting, and IASLC. This detailed examination provides businesses with essential insights for competitive intelligence and market trend forecasting, supporting the formulation of future strategies.

Get in touch with us today to learn how we can provide AACR coverage exclusively for you at the AACR Meeting 2025

Other Business Consulting Services

Healthcare Competitive Intelligence

Healthcare Licensing Services

Healthcare Portfolio Management

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

CONTACT: Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com

- A Letter from the company’s shareholder regarding the intention to submit a tender offer, aimed at delisting the shares of the company from trading on AB Nasdaq Vilnius was received - July 4, 2025

- Sonoro Gold Secures All Surface Rights for the PROPOSED Cerro Caliche MINING OPERATION - July 4, 2025

- Form 8.3 – [MARLOWE PLC – 03 07 2025] – (CGWL) - July 4, 2025