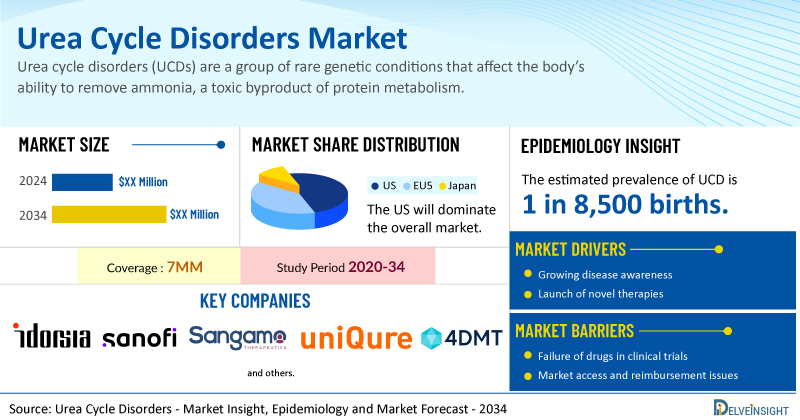

According to DelveInsight’s analysis, the growth of the urea cycle disorders market is expected to be mainly driven by increasing prevalence, patient awareness, advancements in newborn screening, and associated R&D activities during the forecast period (2025–2034).

New York, USA, June 19, 2025 (GLOBE NEWSWIRE) — Urea Cycle Disorders Market to Register Sustainable Growth During the Study Period (2020–2034) | DelveInsight

According to DelveInsight’s analysis, the growth of the urea cycle disorders market is expected to be mainly driven by increasing prevalence, patient awareness, advancements in newborn screening, and associated R&D activities during the forecast period (2025–2034).

DelveInsight’s Urea Cycle Disorders Market Insights report includes a comprehensive understanding of current treatment practices, emerging urea cycle disorders drugs, market share of individual therapies, and current and forecasted urea cycle disorders market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Urea Cycle Disorders Market Report

- According to DelveInsight’s analysis, the total urea cycle disorders market size is expected to grow positively by 2034.

- The estimated prevalence of UCD is 1 in 8,500 births. Many cases likely remain undiagnosed, and in some instances, affected newborns may die without a definitive diagnosis.

- As per the analysis, approximately two-thirds of all UCDs are caused by mutations in the OTC gene, around one-fifth by argininosuccinate synthetase 1 (ASS1), and about one-tenth by argininosuccinate lyase (ASL).

- Prominent companies, including Ultragenyx Pharmaceutical, Arcturus Therapeutics, iECURE, CAMP4 Therapeutics, Scarlet Therapeutics, and others, are actively working on innovative urea cycle disorders drugs. These novel urea cycle disorder therapies are anticipated to enter the urea cycle disorders market in the forecast period and are expected to change the market.

- Some of the key urea cycle disorders treatments include DTX301, LUNAR-OTC, ECUR-506, CMP-CPS-001, LOARGYS, OLPRUVA, RAVICTI, AMMONUL, BUPHENYL, and others.

- In March 2025, iECURE reported data from the OTC-HOPE Phase I/II trial showing that the first infant treated with ECUR-506 achieved a complete clinical response, with signs of restored Ornithine Transcarbamylase (OTC) enzyme activity and urea cycle function.

- In November 2024, Immedica announced that the Biologics License Application (BLA) for pegzilarginase in the treatment of Arginase 1 Deficiency (ARG1-D) was validated and accepted for priority review by the US FDA.

Discover which urea cycle disorder medications are expected to grab the market share @ Urea Cycle Disorders Market Report

Urea Cycle Disorders Overview

Urea cycle disorders (UCDs) are a group of rare genetic conditions that affect the body’s ability to remove ammonia, a toxic byproduct of protein metabolism. Normally, the urea cycle, a series of biochemical reactions occurring primarily in the liver, converts ammonia into urea, which is then safely excreted in urine. In individuals with UCDs, mutations in the genes encoding enzymes of the urea cycle impair this process, leading to the accumulation of ammonia in the bloodstream, a condition known as hyperammonemia. Elevated ammonia levels can cause severe neurological damage, including confusion, vomiting, seizures, coma, and, if untreated, can be fatal.

The severity and onset of UCDs can vary widely, ranging from life-threatening neonatal forms presenting within the first days of life to milder late-onset forms manifesting during childhood or adulthood. Diagnosis typically involves biochemical tests showing elevated ammonia and related metabolites, alongside genetic testing to identify specific mutations. Management of UCDs focuses on reducing ammonia production and enhancing its removal through dietary protein restriction, medications that promote alternative pathways for nitrogen excretion, and, in some cases, liver transplantation. Early diagnosis and intervention are critical to prevent irreversible brain injury and improve long-term outcomes for affected individuals.

Urea Cycle Disorders Epidemiology Segmentation

The urea cycle disorders epidemiology section provides insights into the historical and current urea cycle disorders patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The urea cycle disorders market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Diagnosed Prevalent Cases of Urea Cycle Disorders

- Onset-specific Diagnosed Prevalent Cases of Urea Cycle Disorders

- Type-specific Diagnosed Prevalent Cases of Urea Cycle Disorders

- Treated Cases of Urea Cycle Disorders

Download the report to understand which factors are driving urea cycle disorders epidemiology trends @ Urea Cycle Disorders Treatment Algorithm

Urea Cycle Disorders Treatment Market

The current treatment approach for urea cycle disorders involves three main strategies: pharmacological therapy using nitrogen scavengers, nutritional support with amino acids such as L-citrulline or L-arginine, and a low-protein diet that carefully manages nitrogen intake while supporting growth.

At present, the only definitive cure for UCDs is liver transplantation. This option is typically considered for pediatric patients who do not respond adequately to dietary and medical therapies or those suffering from severe, progressive liver dysfunction and/or frequent episodes of metabolic instability.

FDA-approved therapies for UCDs include OLPRUVA (Acer Therapeutics), AMMONUL (Ucyclyd Pharma), BUPHENYL (Horizon Pharma), and RAVICTI (Horizon Pharma). OLPRUVA, developed by Acer Therapeutics in collaboration with Relief Therapeutics, is a newly approved formulation of sodium phenylbutyrate. The US FDA granted its approval in December 2022 for long-term treatment, in combination with other therapies, of adults and children weighing at least 44 pounds (20 kg) and having a body surface area (BSA) of 1.2 m² or more.

It is indicated for urea cycle disorders caused by deficiencies in carbamylphosphate synthetase (CPS), ornithine transcarbamylase (OTC), or argininosuccinic acid synthetase. In November 2023, Zevra Therapeutics acquired Acer Therapeutics, thereby gaining the rights to OLPRUVA.

RAVICTI, developed by Horizon Pharma, is approved for the ongoing management of UCDs in individuals aged 2 years and above who have specific enzyme deficiencies and cannot be managed through diet alone. The medication helps prevent ammonia accumulation and must be used in conjunction with dietary restrictions. It received US FDA approval in February 2013 and was authorized for marketing in the EU in November 2015. RAVICTI also holds Orphan Drug Designation from both the FDA and the EMA.

Another therapy, LOARGYS, has been approved in Europe for the treatment of arginase 1 deficiency (ARG1-D), also known as hyperargininemia, in adults, adolescents, and children aged 2 years and older.

Learn more about the urea cycle disorders treatment options @ Urea Cycle Disorders Treatment Guidelines

Urea Cycle Disorders Emerging Drugs and Companies

Some of the drugs in the pipeline include DTX301 (Ultragenyx Pharmaceutical), LUNAR-OTC (Arcturus Therapeutics), ECUR-506 (iECURE), and CMP-CPS-001 (CAMP4 Therapeutics), among others.

DTX301, developed by Ultragenyx Pharmaceutical, is designed to provide lasting expression of the OTC gene, aiming to prevent or lessen complications related to OTC deficiency. It has received Orphan Drug Designation (ODD) in the US, Europe, and the UK, as well as Fast Track Designation (FTD) in the US. Long-term Phase I/II results have shown that it has a favorable safety profile, sustained metabolic control, and ongoing therapeutic effects. The company is currently running a Phase III trial (NCT05345171) to assess DTX301’s effectiveness in improving OTC function by maintaining safe plasma ammonia levels while eliminating the need for dietary protein restrictions and alternative pathway treatments.

LUNAR-OTC (ARCT-810) is an mRNA-based therapy encoding OTC, delivered through lipid nanoparticles. It has demonstrated early potential in restoring urea cycle activity and enhancing survival. Currently in Phase II (NCT05526066), this study is evaluating safety, tolerability, and pharmacokinetics in adolescent and adult patients with OTC deficiency, with interim results expected in the first half of 2025. In August 2024, ARCT-810 completed dosing of eight participants in a Phase II double-blind, multiple-dose trial. The program was further extended with an open-label multiple-dose study that started dosing in December 2024. ARCT-810 holds ODD, Rare Pediatric Disease Designation (RPDD), and FTD from the US FDA, as well as ODD from the EMA.

ECUR-506 consists of two components: an ARCUS nuclease vector that performs gene editing at the well-studied PCSK9 gene site, and a donor vector that inserts the functional OTC gene. ECUR-506 is being evaluated in the Phase I/II OTC-HOPE trial (NCT06255782), marking the first clinical program of in vivo meganuclease-based gene insertion. iECURE’s lead candidate GTP-506 (also known as ECUR-506) for treating neonatal OTC deficiency has received FTD, ODD, and RPDD from the US FDA, as well as ODD from the European Commission.

The anticipated launch of these emerging urea cycle disorder therapies are poised to transform the urea cycle disorders market landscape in the coming years. As these cutting-edge urea cycle disorders therapies continue to mature and gain regulatory approval, they are expected to reshape the urea cycle disorders market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about new treatment for urea cycle disorders, visit @ Urea Cycle Disorders Management

Urea Cycle Disorders Market Dynamics

The urea cycle disorders market dynamics are anticipated to change in the coming years. Initial signs of translational promise in early-phase clinical trials involving late-onset OTC-deficient adult patients are paving the way for broader development of gene therapies targeting younger patients and all UCDs; meanwhile, LOARGYS, approved in Europe, stands as the first and only disease-modifying treatment for ARG1-D, and the emerging UCD landscape, featuring various gene and mRNA therapies, holds potential to address the underlying genetic deficiencies, potentially reducing reliance on nitro scavengers through earlier intervention in the urea cycle, while improved understanding of UCD genotypes may enable more personalized treatment plans tailored to specific genetic mutations.

Furthermore, many potential therapies are being investigated for the treatment of urea cycle disorders, and it is safe to predict that the treatment space will significantly impact the urea cycle disorders market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate is expected to drive the growth of the urea cycle disorders market in the 7MM.

However, several factors may impede the growth of the urea cycle disorders market. There is a lack of effective curative therapies to treat UCDs, resulting in a huge unmet medical need in this vulnerable patient population; frequent dosing, poor drug tolerability, and side effects place a significant burden on patients and families, while liver transplant, despite its significant morbidity and mortality, does not correct all metabolic abnormalities, and non-adherence to prescribed drug or dietary management can lead to immediate and severe consequences.

Moreover, urea cycle disorders treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the urea cycle disorders market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the unawareness about the disease may also impact the urea cycle disorders market growth.

| Urea Cycle Disorders Report Metrics | Details |

| Study Period | 2020–2034 |

| Urea Cycle Disorders Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Key Urea Cycle Disorders Companies | Ultragenyx Pharmaceutical, Arcturus Therapeutics, iECURE, CAMP4 Therapeutics, Scarlet Therapeutics, Immedica Pharma, Acer Therapeutics, Horizon Pharma, Ucyclyd Pharma, and others |

| Key Urea Cycle Disorders Therapies | DTX301, LUNAR-OTC, ECUR-506, CMP-CPS-001, LOARGYS, OLPRUVA, RAVICTI, AMMONUL, BUPHENYL, and others |

Scope of the Urea Cycle Disorders Market Report

- Urea Cycle Disorders Therapeutic Assessment: Urea Cycle Disorders current marketed and emerging therapies

- Urea Cycle Disorders Market Dynamics: Conjoint Analysis of Emerging Urea Cycle Disorders Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Urea Cycle Disorders Market Access and Reimbursement

Discover more about urea cycle disorders drugs in development @ Urea Cycle Disorders Clinical Trials

Table of Contents

| 1. | Urea Cycle Disorders Market Key Insights |

| 2. | Urea Cycle Disorders Market Report Introduction |

| 3. | Urea Cycle Disorders Market Overview at a Glance |

| 4. | Urea Cycle Disorders Market Executive Summary |

| 5. | Disease Background and Overview |

| 6. | Urea Cycle Disorders Treatment and Management |

| 7. | Urea Cycle Disorders Epidemiology and Patient Population |

| 8. | Patient Journey |

| 9. | Urea Cycle Disorders Marketed Drugs |

| 10. | Urea Cycle Disorders Emerging Drugs |

| 11. | Seven Major Urea Cycle Disorders Market Analysis |

| 12. | Urea Cycle Disorders Market Outlook |

| 13. | Potential of Current and Emerging Therapies |

| 14. | KOL Views |

| 15. | Unmet Needs |

| 16. | SWOT Analysis |

| 17. | Appendix |

| 18. | DelveInsight Capabilities |

| 19. | Disclaimer |

| 20. | About DelveInsight |

Related Reports

Urea Cycle Disorders Pipeline

Urea Cycle Disorders Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key urea cycle disorders companies, including Acer Therapeutics, Dimension Therapeutics, Callitas Therapeutics, Poseida Therapeutics, Promethera Biosciences, Arcturus Therapeutics, Kaleido Biosciences, Akaza Biopharma, Evox Therapeutics, Dipharma SA, Sana Biotechnology, Aeglea BioTherapeutics, ERYTECH, among others.

Urea Cycle Disorders Epidemiology Forecast

Urea Cycle Disorders Epidemiology Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted urea cycle disorders epidemiology in the 7MM, i.e., the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan.

Hyperammonemia Market

Hyperammonemia Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key hyperammonemia companies including CF Industries, Yara International, Nutrien, OCI, Koch Fertilizer, among others.

Ornithine Transcarbamylase Deficiency Market

Ornithine Transcarbamylase Deficiency Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key ornithine transcarbamylase deficiency companies including Arcturus Therapeutics Inc., Ultragenyx Pharmaceutical Inc., iECURE Inc., Cytonet GmbH & Co. KG, among others.

Ornithine Transcarbamylase Deficiency Epidemiology Forecast

Ornithine Transcarbamylase Deficiency Epidemiology Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted ornithine transcarbamylase deficiency epidemiology in the 7MM, i.e., the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Pharmaceutical Consulting Services

Healthcare Conference Coverage

Pipeline Assessment

Healthcare Licensing Services

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

CONTACT: Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com

- Premier Health Announces a Strategic Review Process to Enhance Shareholder Value - June 19, 2025

- Silly Nice Launches High-THC Full Spectrum Weed Drops Across New York Just in Time for Summer - June 19, 2025

- Making Waves for Marine Life: New York Marine Rescue Center and Canon Celebrate World Sea Turtle Day with Conservation and Education - June 19, 2025