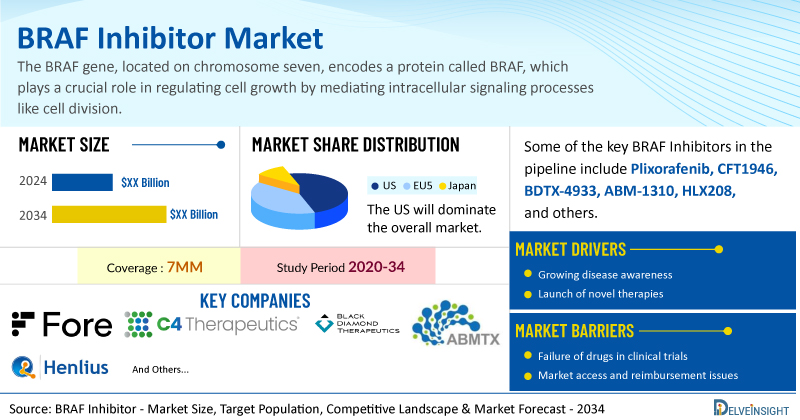

The BRAF Inhibitors market is expected to grow significantly in the coming years. This is due to the increasing number of patients being diagnosed with cancer, rise in biomarker testing rates, the growing usage and awareness of BRAF Inhibitors, and increase in clinical development of next-generation BRAF-targeting therapies.

New York, USA, Jan. 29, 2025 (GLOBE NEWSWIRE) — BRAF Inhibitors Market to Register Incremental Growth During the Study Period (2020–2034) | DelveInsight

The BRAF Inhibitors market is expected to grow significantly in the coming years. This is due to the increasing number of patients being diagnosed with cancer, rise in biomarker testing rates, the growing usage and awareness of BRAF Inhibitors, and increase in clinical development of next-generation BRAF-targeting therapies.

DelveInsight’s BRAF Inhibitor Market Insights report includes a comprehensive understanding of current treatment practices, emerging BRAF inhibitors, market share of individual therapies, and current and forecasted BRAF inhibitor market size from 2020 to 2034, segmented into the 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the BRAF Inhibitor Market Report

- The US Food and Drug Administration (FDA) has approved several BRAF inhibitors for the treatment of cancer types like melanoma, colorectal cancer, and Non-small cell lung cancer (NSCLC). Roche’s ZELBORAF, Pfizer’s BRAFTOVI and Novartis’s TAFINLAR, are among the drugs that target the BRAF protein directly.

- The FDA approved BRAF-targeted therapies are engineered to target class I alterations (BRAF V600 mutations). Patients with melanoma and colorectal cancer, NSCLC, have seen dramatic improvements in the BRAFV600E subset.

- Although BRAF V600E-specific targeted monotherapies increased overall survival and progression-free survival in treating tumors with BRAF V600 mutations, further research revealed that combination treatment with a MEK inhibitor added additional enhanced survival.

- In December 2024, the US Food and Drug Administration (FDA) has approved BRAFTOVI in combination with cetuximab and mFOLFOX6 (fluorouracil, leucovorin, and oxaliplatin) for the treatment of patients with metastatic colorectal cancer with a BRAF V600E mutation. It is the first and only combination regimen with targeted therapy approved for use as early as first-line for patients with metastatic colorectal cancer with a BRAF V600E mutation.

- BRAF-targeted therapies remains an area of active investigation, owing to its potential for antitumor effectiveness against a variety of tumor types. Several companies such as Fore Biotherapeutics, C4 Therapeutics, Black Diamond Therapeutics, ABM Therapeutics, Henlius and others are developing novel BRAF-targeting therapies. Some of the key BRAF-targeting therapies in the pipeline include Plixorafenib, CFT1946, BDTX-4933, ABM-1310, HLX208 and others.

- Companies are currently investigating the possibility of BRAF degraders since BRAF/MEK inhibitor combinations are being utilized to treat a variety of cancer types. Although proof-of-concept for such therapies has been accomplished, it is still unclear if BRAF degraders would be more effective than pan-RAF inhibitors or BRAF/MEK inhibitor combinations.

- Systemic therapies that target class II or class III BRAF alterations are not yet approved. Hence, there is a need for therapies which display activity beyond BRAFV600E.

Discover which therapies are expected to grab the BRAF inhibitor market share @ BRAF Inhibitor Market Report

BRAF Inhibitor Market Dynamics

The BRAF inhibitor market has seen significant developments over the past decade, driven largely by advances in targeted cancer therapy. Market dynamics have been influenced by several factors, including the rising incidence of melanoma and other cancers with BRAF mutations, increasing rates of biomarker testing, growing awareness of personalized medicine, and ongoing research and development in oncology.

The market has seen robust growth as these therapies have expanded beyond melanoma to treat other cancers, such as colorectal cancer and NSCLC, where BRAF mutations are also present, albeit less frequently. However, the market is not without its challenges. Drug resistance, where cancer cells develop resistance to BRAF inhibitors over time, remains a significant hurdle, leading to the need for combination therapies and next-generation inhibitors.

Another dynamic shaping the BRAF inhibitor market is the competitive landscape, which has intensified with the entry of new drugs and combination therapies. Companies are not only focusing on improving the efficacy of BRAF inhibitors but also on reducing side effects and improving patient outcomes through combination regimens that include MEK inhibitors. The approval of combination therapies has set new standards in treatment, offering superior efficacy compared to BRAF inhibitor monotherapy. This trend is expected to continue as more combination therapies are developed and approved, further expanding the market.

Regulatory and pricing pressures also play a crucial role in the market dynamics. The high cost of BRAF inhibitors has led to ongoing debates about pricing and reimbursement, particularly in regions with stringent healthcare budgets. Moreover, the regulatory environment is evolving, with agencies like the FDA and European Medicines Agency (EMA) emphasizing the need for robust clinical evidence to support the approval of new therapies. This has led to increased investment in clinical trials and a focus on demonstrating not just efficacy but also long-term safety and quality-of-life improvements for patients.

Looking forward, the BRAF inhibitor market is poised for continued growth, driven by ongoing innovation and the expansion of indications. The development of next-generation BRAF-targeting therapies, which aim to overcome resistance mechanisms, and the exploration of BRAF inhibitors in combination with other therapies, such as immunotherapies, are expected to open new avenues for treatment. Additionally, the growing emphasis on personalized medicine and the identification of new biomarkers will likely lead to more tailored therapies, further boosting the market. However, the success of these therapies will depend on navigating the challenges of drug resistance, competition, and regulatory hurdles.

BRAF Inhibitor Treatment Market

BRAF inhibitors are primarily used to treat cancers with a specific mutation in the BRAF gene, most notably melanoma, where the mutation occurs in about 50% of cases. The introduction of these inhibitors marked a turning point in the treatment of BRAF-mutant cancers, offering more personalized and effective treatment options. Key players in the market include pharmaceutical giants like Roche, Pfizer and Novartis who have developed well-known drugs such as ZELBORAF (vemurafenib), BRAFTOVI (encorafenib) and TAFINLAR (dabrafenib).

Pfizer’s BRAFTOVI is a targeted therapy used in treating several aggressive cancers. When paired with MEKTOVI (binimetinib), it plays a crucial role in managing advanced melanoma, colorectal cancer, and NSCLC. For patients with metastatic or inoperable melanoma that contains a specific abnormal BRAF gene, BRAFTOVI offers a promising treatment option. In cases of advanced colorectal cancer with a BRAF mutation, the combination of BRAFTOVI and cetuximab provides new hope.

In October 2023, the FDA approved the combination of BRAFTOVI and MEKTOVI for treating adult patients with metastatic NSCLC with a BRAF V600E mutation. Earlier, in April 2020, the FDA approved BRAFTOVI (encorafenib) with cetuximab (ERBITUX) for treating adults with metastatic colorectal cancer carrying the BRAFV600E mutation. In June 2018, the FDA approved the combination of encorafenib and binimetinib (BRAFTOVI and MEKTOVI, developed by Array Biopharma) for patients with unresectable or metastatic melanoma with a BRAF V600E or V600K mutation.

TAFINLAR, in combination with MEKINIST (trametinib), is approved for treating patients with unresectable or metastatic melanoma that has BRAF V600E or V600K mutations. TAFINLAR and MEKINIST target different kinases in the RAS/RAF/MEK/ERK pathway, and using them together has shown greater inhibition of growth in BRAF V600 mutation-positive tumor cell lines in vitro and extended tumor growth inhibition in BRAF V600 mutation-positive tumor models compared to using either drug alone. On March 16, 2023, the FDA approved the use of TAFINLAR with trametinib for pediatric patients aged 1 year and older with low-grade glioma that has a BRAF V600E mutation and requires systemic therapy. The FDA also approved new oral formulations of both drugs for patients who cannot swallow pills.

Learn more about the FDA-approved BRAF inhibitor @ BRAF Inhibitor Drugs

Key Emerging BRAF Inhibitors and Companies

Several key players, including Fore Biotherapeutics (Plixorafenib), C4 Therapeutics (CFT1946), ABM Therapeutics (ABM-1310), Henlius (HLX208), Black Diamond Therapeutics (BDTX-4933), and others, are involved in developing drugs for BRAF Inhibitor for various indications such as Metastatic Melanoma, Metastatic Colorectal Cancer, Metastatic Non-small cell lung cancer, Anaplastic Thyroid Cancer, Glioma and others.

Plixorafenib (formerly known as FORE8394 or PLX-8394) is an experimental, next-generation small-molecule drug that selectively inhibits mutated BRAF. Its ability to block ERK signaling makes it a promising candidate for treating tumors driven by class I or II BRAF mutations and fusions. The US FDA has granted Orphan Drug designation for Plixorafenib in treating primary brain and central nervous system cancers, as well as Fast Track designation for cancers with BRAF Class 1 (V600) and Class 2 (including fusions) mutations in patients who have exhausted other treatment options. The drug is currently in Phase II clinical trial.

CFT1946 is an investigational, orally bioavailable small molecule degrader of BRAF V600 mutations in solid tumors currently being evaluated in a Phase I/II global clinical trial in patients refractory to BRAF inhibitors. CFT1946 is designed to be potent and selective against the BRAF V600 mutant form. It is worth noting that CFT1946 is the only degrader of BRAF V600 mutant solid tumors in clinical trials. For the treatment of primary and inhibitor-resistant solid cancers, companies such as Nurix Therapeutics are in the discovery stages of development with their orally bioavailable, brain penetrant, panmutant BRAF Degrader.

BDTX-4933 is a Master Key inhibitor targeting Class I, II, and III oncogenic RAF mutations. Preclinical studies suggest that BDTX-4933 can function as an “RAF-RAS clamp,” effectively blocking signaling from mutant KRAS and NRAS. Its development is focused on treating recurrent advanced/metastatic NSCLC with non-G12C KRAS or BRAF mutations, advanced/metastatic melanoma with BRAF or NRAS mutations, histiocytic neoplasms with BRAF or NRAS mutations, and other solid tumors harboring BRAF mutations. BDTX-4933 is currently in a Phase I trial and the company is evaluating partnering opportunities.

The market landscape for BRAF-targeting therapies is expected to change in the upcoming years due to the limited approved treatment options for BRAF V600 patients who do not have a BRAF V600E or V600K mutation and the high rates of cutaneous adverse events of approved BRAF therapies. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the BRAF-targeting therapies market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about BRAF inhibitor clinical trials, visit @ BRAF Inhibitor Treatment Drugs

BRAF Mutation Overview

The BRAF gene, located on chromosome seven, encodes a protein called BRAF, which plays a crucial role in regulating cell growth by mediating intracellular signaling processes like cell division. When a mutation occurs, it can cause the gene to activate the BRAF protein continuously, leading to cells receiving constant signals to divide without proper regulation. This can contribute to tumor development. Numerous BRAF mutations have been identified, with one of the most common being the BRAF V600E mutation, which indicates the specific nature and position of the mutation. BRAF gene mutations are linked to various types of cancers, not limited to a single body part or cell type. These include Melanoma (where about half of all cases involve the BRAF Inhibitor gene mutation), Hairy cell leukemia, Non-Hodgkin lymphoma, Thyroid cancer, Ovarian cancer, Lung adenocarcinoma, Colorectal cancer, and certain brain cancers such as glioblastoma, pilocytic astrocytoma, and pediatric low-grade glioma.

BRAF Mutation Epidemiology Segmentation

More than 90% of BRAF mutations in cancer are caused by class I BRAF mutations, namely BRAF V600 mutations. Class II and class III BRAF mutations are the two categories into which non-V600 BRAF mutations may be classified according to their signaling characteristics and dependence on RAS activation.

In NSCLC, BRAF gene mutations occur in around 1-5%, with V600E mutations accounting for almost half of all BRAF mutations. In the United States, there are about 10,400 incident cases (2023 estimates). Among EU4 and the UK, the highest number of cases for BRAF NSCLC was found in Germany, estimated to be nearly 2,150 in 2023. This number is expected to show positive growth by 2034.

The BRAF inhibitor market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Incident Cases of Selected Indication with BRAF mutation

- Total Eligible Patient Pool for BRAF Inhibitor in Selected Indications

- Total Treatable Cases in Selected Indication for BRAF Inhibitor

Download the report to understand what epidemiologists are saying about how BRAF inhibitor patient trends in 7MM @ BRAF Inhibitor Epidemiological Insights

| BRAF Inhibitor Report Metrics | Details |

| Study Period | 2020–2034 |

| BRAF Inhibitor Report Coverage | 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Key BRAF Inhibitor Companies | Pfizer, Novartis, Roche, Fore Biotherapeutics, C4 Therapeutics, Black Diamond Therapeutics, ABM Therapeutics, Henlius, and others |

| Key BRAF Inhibitor | BRAFTOVI, TAFINLAR, ZELBORAF, Plixorafenib, CFT1946, BDTX-4933, ABM-1310, HLX208 and others |

Scope of the BRAF Inhibitor Market Report

- BRAF Inhibitor Therapeutic Assessment: BRAF Inhibitor current marketed and emerging therapies

- BRAF Inhibitor Market Dynamics: Conjoint Analysis of Emerging BRAF Inhibitor Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, BRAF Inhibitor Market Access and Reimbursement

Discover more about BRAF inhibitor drugs in development @ BRAF Inhibitor Clinical Trials

Table of Contents

| 1. | Key Insights |

| 2. | Report Introduction |

| 3. | Executive Summary |

| 4. | Key Events |

| 5. | Market Forecast Methodology |

| 6. | BRAF Inhibitor Market Overview at a Glance in the 7MM |

| 6.1. | Market Share (%) Distribution by Therapies in 2020 |

| 6.2. | Market Share (%) Distribution by Therapies in 2034 |

| 7. | BRAF Mutation: Background and Overview |

| 8. | Treatment and Management |

| 9. | Target Patient Pool |

| 9.1. | Key Findings |

| 9.2. | Assumptions and Rationale: 7MM |

| 9.3. | Epidemiology Scenario in the 7MM |

| 9.3.1. | Total Incident Cases of Selected Indication with BRAF mutation in the 7MM |

| 9.3.2. | Total Eligible Patient Pool for BRAF Inhibitor in Selected Indications in the 7MM |

| 9.3.3. | Total Treated Cases in Selected Indications for BRAF Inhibitor in the 7MM |

| 10. | Marketed Therapies |

| 10.1. | Key Competitors |

| 10.2. | BRAFTOVI (encorafenib): Pfizer |

| 10.2.1. | Product Description |

| 10.2.2. | Regulatory milestones |

| 10.2.3. | Other developmental activities |

| 10.2.4. | Clinical development |

| 10.2.5. | Safety and efficacy |

| 10.3. | TAFINLAR (dabrafenib): Novartis |

| 10.3.1. | Product Description |

| 10.3.2. | Regulatory milestones |

| 10.3.3. | Other developmental activities |

| 10.3.4. | Clinical development |

| 10.3.5. | Safety and efficacy |

| List to be continued in the report | |

| 11. | Emerging Therapies |

| 11.1. | Key Competitors |

| 11.2. | BDTX-4933: Black Diamond Therapeutics |

| 11.2.1. | Product Description |

| 11.2.2. | Other developmental activities |

| 11.2.3. | Clinical development |

| 11.2.4. | Safety and efficacy |

| 11.3. | Plixorafenib: Fore Biotherapeutics |

| 11.3.1. | Product Description |

| 11.3.2. | Other developmental activities |

| 11.3.3. | Clinical development |

| 11.3.4. | Safety and efficacy |

| List to be continued in the report | |

| 12. | BRAF Inhibitor: Seven Major Market Analysis |

| 12.1. | Key Findings |

| 12.2. | Market Outlook |

| 12.3. | Conjoint Analysis |

| 12.4. | Key Market Forecast Assumptions |

| 12.4.1. | Cost Assumptions and Rebates |

| 12.4.2. | Pricing Trends |

| 12.4.3. | Analogue Assessment |

| 12.4.4. | Launch Year and Therapy Uptakes |

| 12.5. | Total Market Size of BRAF Inhibitor in the 7MM |

| 12.6. | Market Size of BRAF Inhibitor by Indication in the7MM |

| 12.7. | The United States Market Size |

| 12.7.1. | Total Market Size of BRAF Inhibitor in the United States |

| 12.7.2. | Market Size of BRAF Inhibitor by Indication in the United States |

| 12.7.3. | Market Size of BRAF Inhibitor by Therapies in the United States |

| 12.8. | EU4 and the UK Market Size |

| 12.8.1. | Total Market Size of BRAF Inhibitor in EU4 and the UK |

| 12.8.2. | Market Size of BRAF Inhibitor by Indication in EU4 and the UK |

| 12.8.3. | Market Size of BRAF Inhibitor by Therapies in EU4 and the UK |

| 12.9. | Japan Market Size |

| 12.9.1. | Total Market Size of BRAF Inhibitors in Japan |

| 12.9.2. | Market Size of BRAF Inhibitor by Indication in Japan |

| 12.9.3. | Market Size of BRAF Inhibitors by Therapies in Japan |

| 13. | SWOT Analysis |

| 14. | KOL Views |

| 15. | Unmet Needs |

| 16. | Market Access and Reimbursement |

| 17. | Appendix |

| 17.1. | Bibliography |

| 17.2. | Report Methodology |

| 18. | DelveInsight Capabilities |

| 19. | Disclaimer |

| 20. | About DelveInsight |

Related Reports

BRAF Metastatic Non-small Cell Lung Cancer Market

BRAF Metastatic Non-small Cell Lung Cancer Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key BRAF mNSCLC companies, including Pierre Fabre Medicament, Xynomic Pharmaceuticals, Inc., Kinnate Biopharma, Revolution Medicines, Inc., Black Diamond Therapeutics, Inc., among others.

Non-small Cell Lung Cancer Market

Non-small Cell Lung Cancer Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key NSCLC companies, including EMD Serono, Merck, Cellular Biomedicine Group, Inc., Celgene, CellSight Technologies, Inc., BeyondSpring Pharmaceuticals Inc., J Ints Bio, Forward Pharmaceuticals Co., Ltd., AstraZeneca, Bristol-Myers Squibb, Teligene US, Rain Oncology Inc, ReHeva Biosciences, Inc., Amgen, Novartis, RedCloud Bio, Parexel, Vitrac Therapeutics, LLC, Mythic Therapeutics, Instil Bio, Mirati Therapeutics Inc., Daiichi Sankyo, Inc., AstraZeneca, Precision Biologics, Inc, Promontory Therapeutics Inc., Palobiofarma SL, Regeneron Pharmaceuticals, Revolution Medicines, Inc., Cullinan Oncology, LLC, Iovance Biotherapeutics, Inc., Innate Pharma, among others.

Non-small Cell Lung Cancer Pipeline

Non-small Cell Lung Cancer Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key NSCLC companies, including BridgeBio Pharma, Daiichi Sankyo, EMD Serono, Merck, BridgeBio Pharma, Abbvie, Pfizer, Eli Lilly and Company BioNTech SE, Shenzhen TargetRx, Taiho Pharmaceutical, Chong Kun Dang, Bristol Myers Squibb, Innovent Biologics, Xuanzhu Biopharmaceutical, Bayer, GeneScience Pharmaceuticals, InventisBio, Apollomics, Imugene, Ono Pharmaceutical, Pierre Fabre, Jiangsu Hengrui Medicine Co., Bristol-Myers Squibb, Surface Oncology, Inhibrx, Sinocelltech, Mirati Therapeutics, REVOLUTION Medicines, Yong Shun Technology Development, Iovance Biotherapeutics, Galecto Biotech, among others.

Small-Cell Lung Cancer Market Insight, Epidemiology, and Market Forecast – 2032 report delivers an in-depth understanding of the market trends, market drivers, market barriers, and key SCLC companies, including Medicine Invention Design, Inc, Advenchen Laboratories, LLC, Bristol-Myers Squibb, Clovis Oncology, Inc., Cardiff Oncology, Legend Biotech USA Inc, Bellicum Pharmaceuticals, Genentech, Inc., Phanes Therapeutics, AbbVie, Amgen, Daiichi Sankyo, Inc., HiberCell, Inc., Hoffmann-La Roche, Harpoon Therapeutics, BioNTech SE, Boehringer Ingelheim, Chipscreen Biosciences, Ltd., Andarix Pharmaceuticals, Telix International Pty Ltd, Syros Pharmaceuticals, Jacobio Pharmaceuticals Co., Ltd., Cybrexa Therapeutics, among others.

Small-Cell Lung Cancer Pipeline

Small-Cell Lung Cancer Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key small-cell lung cancer companies, including Ascentage Pharma, Merck & Co, AstraZeneca, Advenchen Laboratories, GlaxoSmithKline, Advanced Accelerator Applications, Trillium Therapeutics, Vernalis, Oncoceutics, NewBio Therapeutics, Wigen Biomedicine, Linton Pharm, Carrick Therapeutics, Xencor, Jiangsu HengRui Medicine, Aileron Therapeutics, Roche, Ipsen, Celgene, Lee’s Pharmaceutical Limited, AbbVie, G1 Therapeutics, Chipscreen Biosciences, Luye Pharma Group, Shanghai Henlius Biotech, CSPC ZhongQi Pharmaceutical Technology, Impact Therapeutics, among others.

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

CONTACT: Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com