The Keltner Channels, developed by Chester W. Keltner, are, envelopes, or moving average bands. They consist of three lines (upper, middle, and lower). Envelopes, in general, states that prices have the greatest probability of trading within the boundaries set by the upper and lower lines. Prices that fluctuate outside of these borders are considered irregular and therefore, represent trading opportunities.

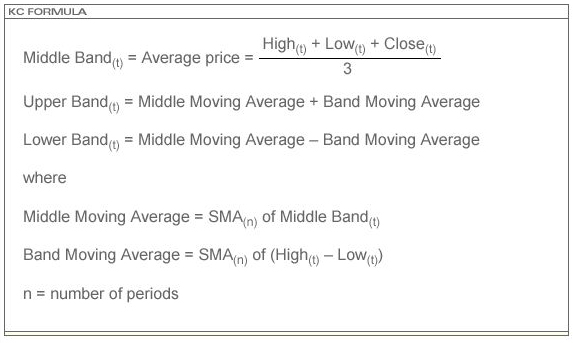

The formula for the Keltner Channels is:

The Keltner Channels is an upper technical study. ProSticks uses a default parameter value of 10 bars to calculate the Keltner Channels.

Initially, Keltner’s interpretation of this indicator was that there would be bullishness if the price traded above the upper band, whereas if the price traded below the lower band, a bearish sentiment would result.

However, the Keltner Channels can also be applied in a similar way as the Bollinger Bands. The upper and lower bands are considered extremes and act as a warning sign that the price may be in an overbought or oversold state. From this view then, buy signals occur when the price is below the lower band and sell signals occur when the price exceeds the upper band.