The Money Flow Index (MFI) is used to measure the strength of money flowing in and out of a security. The MFI is similar to the Relative Strength Index (RSI), but also takes into consideration volume action.

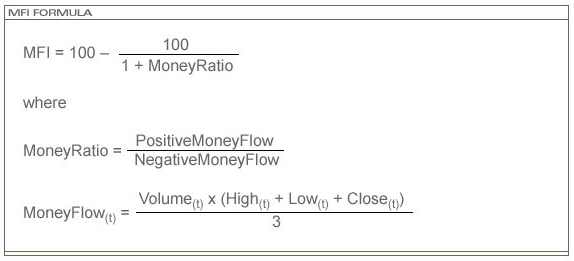

The formula for the MFI is:

The MFI is a lower technical study. ProSticks uses a default parameter value of 14 bars to calculate the MFI.

The average, or typical, price is first calculated (i.e. ((H + L + C) / 3) ). Next, calculate the MoneyFlow by multiplying the volume with the average price. If the current period’s average price is greater than the previous period’s average price, it is considered PositiveMoneyFlow. If it is less than the previous average price, it is considered NegativeMoneyFlow. Then sum up all of the PositiveMoneyFlow and NegativeMoneyFlow for a specified period. The MoneyRatio is then calculated by dividing PositiveMoneyFlow by the NegativeMoneyFlow. The MFI can now be calculated using the MoneyRatio.

The MFI helps identify market tops and bottoms. A value above 80 signals a possible top, and a reversal may be in order. Conversely, a value below 20 indicates a possible market bottom.