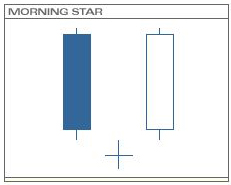

A morning star is a bullish candlestick reversal pattern made up of three candlesticks. The pattern follows a decline, or down-trend.

A morning star is a bullish candlestick reversal pattern made up of three candlesticks. The pattern follows a decline, or down-trend.

The first candlestick is a relatively long black candlestick and forms in the same direction of the prevailing down-trend. This signals that the market is still very bearish toward the price of the security.

The middle candlestick is a doji or spinning top that forms after a gap down on the open. This signals indecisiveness in the market as the bulls have surfaced and the selling pressure has been eased off.

The last candlestick is a relatively long white candlestick. This signals that the indecisiveness in the previous day has been resolved and that a reversal to the upside is under way.

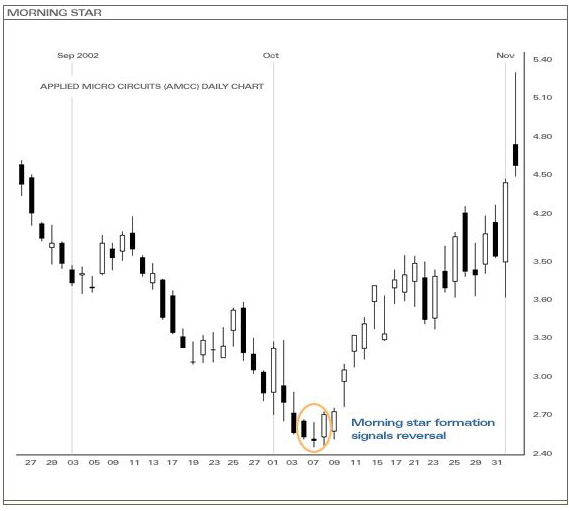

In the above example, prior to the morning star formation, the price was in a down-trend and very bearish. However, once the spinning top was formed, all the selling dried up and the market reversed to the upside the following day.