The ascending triangle is a bullish formation that usually forms during an up-trend and indicates accumulation. In most cases, the formation is a continuation pattern with some instances of reversals at the end of a down-trend.

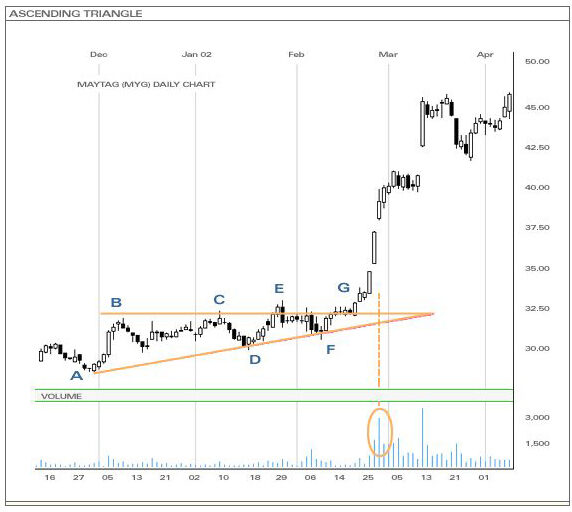

Two or more highs approximately equal to one another form a horizontal line at the top (upper resistance) and two or more lows, one higher than the previous one, form an ascending trend line (lower support) that converges on the horizontal line as it rises.

As the pattern develops, volume levels usually lessen and are quite flat. This is simply a quiet period before the storm. When the upside breakout occurs, there should be an expansion of volume to confirm the breakout and continuation of the current up-trend (or reversal of the prevailing down-trend).

And as in most cases, once the resistance is broken, it transforms into a support level for future price movements. When the horizontal resistance line of the ascending triangle is broken, it turns into support. Sometimes the price will re-test this support level before the upside move resumes.

In contrast to the symmetrical triangle where a breakout is needed to determine the bias of the market, an ascending triangle pattern has a more definitive bullish bias due to the higher reaction lows as the formation extends to the right. It is these higher lows that indicate increased buying pressure and give the pattern its bullish bias.

In the above example, the price was in a slight up-trend as it began to form the ascending triangle pattern. The price, in a 3-month span, was not able to break resistance at points B, C, and E. Higher lows were formed from point A to points D and F, indicating accumulation and bullishness. Volume was weak as expected during the formation and began to pick up at point F. The support trend line held nicely during the last test of support and the price finally rebounded and broke through resistance at point G on heavy volume. The ascending triangle formation had been confirmed and the price resumed its up-trend move.