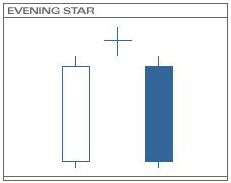

An evening star is a bearish candlestick reversal pattern made up of three candlesticks. The pattern follows an advance, or up-trend.

An evening star is a bearish candlestick reversal pattern made up of three candlesticks. The pattern follows an advance, or up-trend.

The first candlestick is a relatively long white candlestick and forms in the same direction of the prevailing up-trend. This signals that the market is still very bullish toward the price of the security.

The middle candlestick is a doji or spinning top that forms after a gap up on the open. This signals indecisiveness in the market as the bears have surfaced and the buying pressure has slowly diminished. Moreover, a long upper shadow, thus resembling a shooting star, would be more convincing that a reversal is imminent.

The last candlestick is a relatively long black candlestick. This signals that the indecisiveness in the previous day has been resolved and that a reversal to the downside is under way.

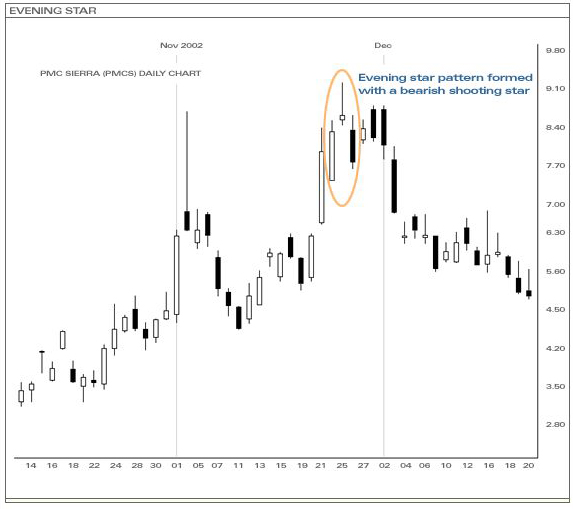

In the above example, prior to the evening star formation, the price was in an up-trend and very bullish. However, once the shooting star took was formed, all the buying dried up and the market eventually reversed to the downside a few days later.