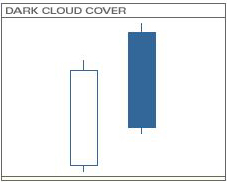

A dark cloud cover pattern is a bearish candlestick reversal pattern that forms after an advance, or up-trend. Two candlesticks are required to form a dark cloud cover pattern.

A dark cloud cover pattern is a bearish candlestick reversal pattern that forms after an advance, or up-trend. Two candlesticks are required to form a dark cloud cover pattern.

The first candlestick is a relatively long white candlestick, signalling continued bullishness and strength in the price. The second candlestick is a black candlestick that opens above the first candlestick’s close and closes below the mid-point of the previous day’s body. In fact, if analyzed further, if one would combine the two candlesticks by taking the open of the first and the close of the second, a shooting star is formed, which also represents a bearish formation.

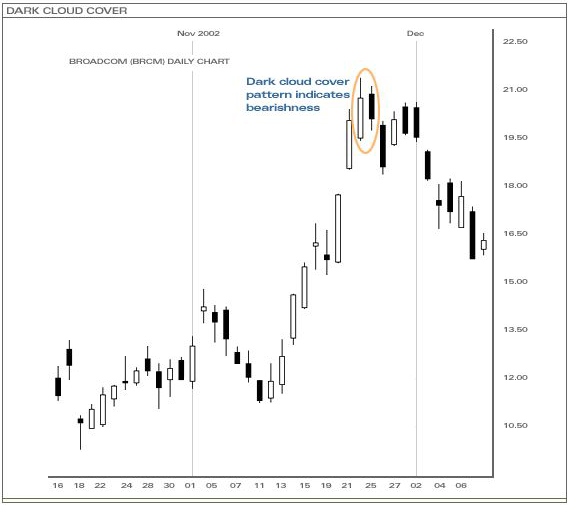

In the above example, the price was in a long up-trend and showed continued strength as a long white candlestick was formed (i.e. dark cloud cover). Then a dark cloud cover developed and a potential reversal was imminent. The gap-down the following day, coupled with the bearish long black candlestick, confirmed the bearishness of the dark cloud cover formation and the price reversed to the downside right afterwards.